Aug 10, 2020

Oil Holds Gains on U.S. Stimulus Optimism, Signs of Virus Easing

, Bloomberg News

(Bloomberg) -- Oil held onto gains in Asia on signs that the U.S. may move forward with another economic stimulus deal that could bolster consumption, and as the growth in new coronavirus cases begins to ease.

Futures in New York were little changed after rising 1.8% on Monday, the biggest one-day gain in a week. Treasury Secretary Steven Mnuchin said that there are areas where compromise over a massive aid bill is possible and a “fair deal” could be agreed upon. Meanwhile, a recovery in the U.S. is seeing some momentum: new Covid-19 cases have decelerated by the most since the start of the pandemic and applications for unemployment benefits dropped to a pandemic low.

Saudi Aramco’s upbeat view on the prospects for a market recovery also boosted sentiment, with Chief Executive Officer Amin Nasser saying Sunday that crude demand in Asia is almost back to pre-coronavirus levels.

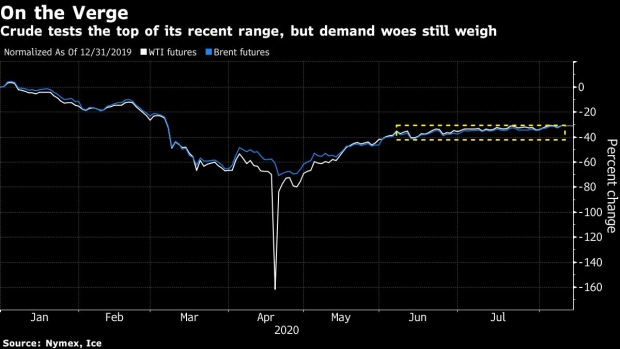

Oil is poised to break through the top end of the range which has contained it for months, but remains weighed down by the Covid-19 pandemic that’s casting doubt on a sustained economic rebound. Adding to price pressure, the OPEC+ alliance is unleashing crude back onto the market this month following historic output cuts.

In a sign of recovering consumption, the quantity of commercial flights around the world rose almost 6% in the seven days to Sunday, according to FlightRadar24 data. The average number of 67,000 planes in the sky was still far below the more than 100,000 pre-Covid.

Norway may not officially be part of the OPEC+ alliance to curb oil supply in the face of the coronavirus pandemic, but next month it looks like the Scandinavian country will do its bit toward helping the producer alliance to avert a global glut of crude. Norway’s main oil loadings will drop by 261,000 barrels a day in September, according to shipping schedules seen by Bloomberg.

©2020 Bloomberg L.P.