Dec 30, 2020

Oil Poised for Best Year Since 2016 as Middle East Risks Flare

, Bloomberg News

(Bloomberg) -- Oil is poised for the biggest yearly gain since 2016 as fresh geopolitical tensions erupted in the Middle East and as U.S. crude stockpiles are forecast to extend declines.

Futures were steady in New York after easing slightly Monday from the highest close in three months. Iran detained a ship carrying smuggled fuel near the Strait of Hormuz following U.S. air strikes on five Iran-backed militia bases in Iraq and Syria. American crude stockpiles are forecast to fall for a third week, according to a Bloomberg survey before government data on Friday.

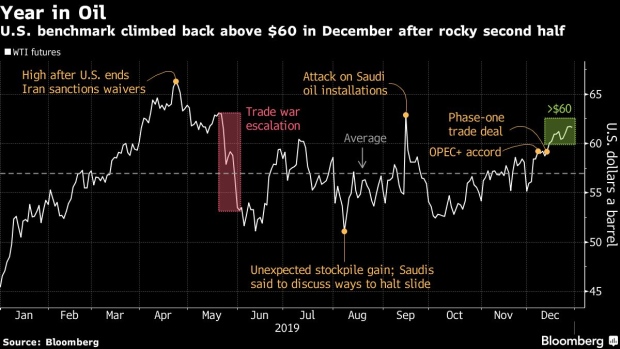

Oil has gained more than 35% in 2019, buoyed by a recent breakthrough in the U.S.-China trade dispute and an agreement by the Organization of Petroleum Exporting Countries and its allies to deepen output cuts. It’s been a tumultuous year for prices, which saw the biggest plunge in four years in August due to tariff threats on Beijing by President Donald Trump, before prices spiked the most in more than a decade in September after strikes on Saudi Arabia.

“The U.S.-China trade war was in the driver’s seat when we entered 2019 and remains there as we exit the year,” said Vandana Hari, founder of industry consultant Vanda Insights in Singapore. Geopolitical concerns continue to linger, while OPEC+ collaboration is going strong. President Trump is “the biggest wildcard for the oil market,” she added.

West Texas intermediate for February delivery slipped 6 cents to $61.60 a barrel on the New York Mercantile Exchange as of 11:45 a.m. Singapore time. The contract fell 4 cents to close at $61.68 on Monday.

Brent for March settlement lost 8 cents to $66.59 a barrel on London’s ICE Futures Europe exchange. Front-month prices are up 23% this year, also set for the biggest annual gain since 2016. The global benchmark crude was trading at a $6.80 premium to WTI for the same month.

Iran detained the tanker and its crew members near Abu Musa island, state-run Islamic Republic News Agency reported. The seizure follows a rare direct strike by the U.S. on Iranian-backed militia, aimed at sending a warning to Tehran. The attack may escalate tensions amid the Trump administration’s crippling economic sanctions on the OPEC member.

U.S. crude stockpiles probably declined by 3 million barrels last week, according to the survey before Energy Information Administration data on Friday. Industry figures are due later on Tuesday.

--With assistance from James Thornhill.

To contact the reporter on this story: Saket Sundria in Singapore at ssundria@bloomberg.net

To contact the editors responsible for this story: Serene Cheong at scheong20@bloomberg.net, Ben Sharples, Sharon Cho

©2019 Bloomberg L.P.