Jun 23, 2021

Oil producers to make record profits this year, report says

, Bloomberg News

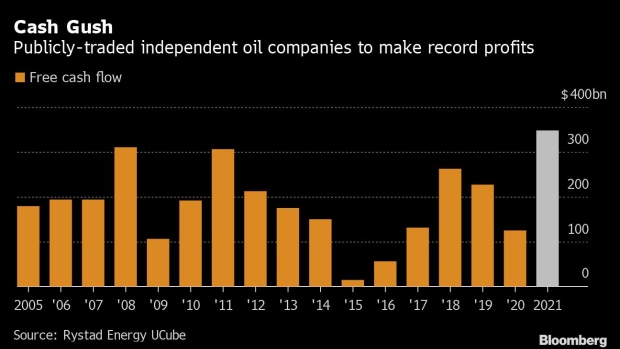

The world’s publicly traded independent oil producers will make record profits this year, surpassing the levels reached when crude hit an all-time high near US$150 a barrel more than a decade ago, according to Rystad Energy.

Combined free cash flow from the sector is expected to surge to US$348 billion, beating the previous high of US$311 billion in 2008, Rystad said. Key to the turnaround is U.S. shale, with the industry expected to reverse years of losses in 2021 and make "super profits" of nearly US$60 billion of free cash flow before hedges.

Surging oil prices will add to producers’ revenue, but profits will be super-charged by executives determined to constrain capital spending on new output, the Oslo-based consultant said in a note authored by Espen Erlingsen, head of upstream research. This is the opposite of previous cycles, when crude rallies prompted companies to spend heavily on exploration and production in search of fresh supplies.

But the forecast raises questions about how disciplined producers will remain about keeping output in check as the surge in crude prices drives outsized profits. So far, explorers have largely heeded investor pressure to rein in spending and return cash to shareholders. While the industry’s revenue is expected to jump 55 per cent in 2021 from last year, capital investment will only increase 2 per cent, Rystad said.

All the money sloshing around may spur more mergers and acquisitions, however, with transaction values already up 30 per cent on last year, the research firm said. Brent oil prices are up 46 per cent this year to trade above US$75 a barrel, with some traders and executives seeing the possibility of a rally to US$100.