Jun 6, 2023

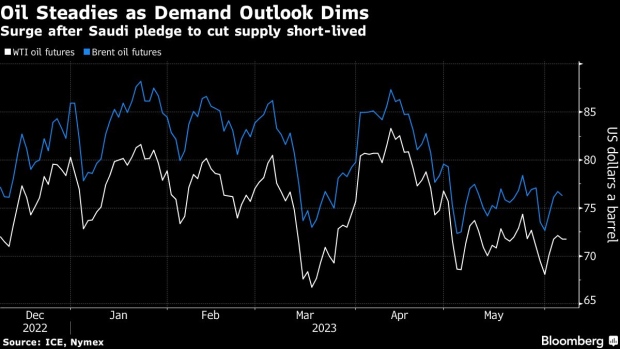

Oil Steadies as Concerns Over Demand Overshadow Saudi Output Cut

, Bloomberg News

(Bloomberg) -- Oil rose amid dollar weakness while traders pointed to the highest refinery runs in the US since 2019 as a harbinger of strong summer demand to come.

West Texas Intermediate settled above $72 a barrel on Wednesday after a government report showed refineries increasing their crude processing to the highest since August 2019. A build in US gasoline inventories was likely a consequence of refiners ramping up production in preparation for summer demand, said Rob Thummel, a portfolio manager at Tortoise Capital Advisors.

“Refined product demand is pretty strong, and it’s just getting started,” said Thummel. The report is signaling “that you’re going to need a lot more US crude and I think that’s a positive sign for prices.” Inventories for the motor fuel continue to be at seasonally low levels for the summer driving season.

Strong Chinese crude imports in May and Saudi Arabia’s recently announced July supply cut also supported oil price

Oil has lost around 10% this year amid concerns about China’s recovery and a rapid increase in interest rates by the US Federal Reserve. Russian crude flows also remain high, even after the nation said it would reduce output. China’s crude oil imports topped 12 million barrels a day in May, part of a wider set of strong commodity data. That said, its trade exports fell by more than expected, adding to growth concerns.

The outlook for the Chinese economy is key for oil markets, according to the International Energy Agency’s executive director Fatih Birol.

“There are many uncertainties, as usual, when it comes to the oil market, and if I have to pick the most important one it’s China,” Birol said in an interview with Bloomberg TV on Wednesday. “Of more than 2 million barrels a day of growth we expect this year in global oil demand, 60% is set to come from China.”

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.

©2023 Bloomberg L.P.