Nov 16, 2022

OPEC+ Oil Cuts Spell Tight Stockpiles Despite Demand Headwinds

, Bloomberg News

(Bloomberg) -- Planned output cuts from the OPEC+ group of oil producers will keep global stockpiles tight over the coming months, according to the latest outlooks from the world’s three big forecasting agencies.

After converging in October, oil demand forecasts for 2022 from the International Energy Agency, the US Energy Information Administration and the Organization of Petroleum Exporting Countries diverged again this month. While the two consumer-focused groups increased their assessments of demand, forecasters at OPEC continued to grow more bearish and are now the most pessimistic of the three groups for the first time this year. That may explain why the group and its allies decided to cut their output target when they met last month.

A deteriorating economic outlook in the midst of rampant inflation, China’s ongoing Covid Zero policy and Russia’s invasion of Ukraine are weighing on oil demand outlooks. While the IEA and the EIA were quick to cut their forecasts for global oil demand after Moscow’s troops crossed the border in February, OPEC’s analysts have responded much more slowly.

By October, all three groups had converged on a figure of just over 99.6 million barrels a day as an average for the year, but the producer group’s analysts continued to cut their forecast in the latest report, while the IEA and EIA both increased theirs, widening the gap again. Even so, the difference between the highest and the lowest forecast is just 260,000 barrels a day, or 0.26% of total demand.

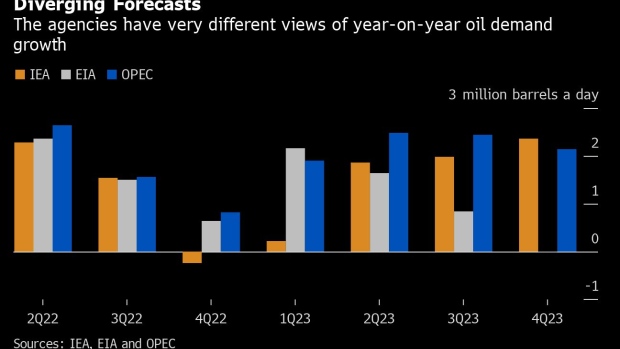

But this apparent agreement on an annual average figure hides some much bigger differences in their views of the current quarter and the next.

The IEA sees global oil demand contracting on a year-on-year basis in the final quarter of 2022 and growing by only a tiny amount at the start of next year. The EIA and OPEC both have much more positive views of oil consumption, seeing growth of about 750,000 barrels a day this quarter, rising to about 2 million barrels a day in the first three months of next year.

Forecasts converge briefly for the second quarter of 2023 before diverging again for the second half of the year, this time with the US-based EIA taking a more pessimistic view.

The differing views on demand have implications for output decisions from the OPEC+ producer group, which unites the 13 OPEC members with 10 allied countries. When they last met, in early October, the alliance decided to cut their output target by 2 million barrels a day with effect from the beginning of November. The cut in actual production will be much smaller, with many of the group’s members already pumping well below their targets. Some of the real cuts that are expected from the likes of Saudi Arabia, Kuwait and the United Arab Emirates will be offset by rising production in Kazakhstan and Nigeria.

The OPEC members of the alliance pumped 29.5 million barrels a day of crude last month, according to data compiled from the secondary sources they use to monitor output levels.

Keeping their output flat at that level would result in small increases in global oil inventories, averaging less than 200,000 barrels a day, over the current quarter and through the first half of next year.

And they need to be rebuilt. Commercial oil stockpiles in the OECD countries were sufficient to meet just 58 days worth of forward demand at the end of 3Q22. That’s about four days less than the pre-pandemic level of cover. Emergency stockpiles controlled by governments were about six days lower using the same measure.

Whether those stockpiles can be replenished will depend on both the depth of the output cut and the resilience of global oil demand over the Northern Hemisphere winter. Both remain highly uncertain.

©2022 Bloomberg L.P.