Feb 17, 2023

OPEC’s Static Oil Supply Strategy Promises Year of Two Halves

, Bloomberg News

(Bloomberg) --

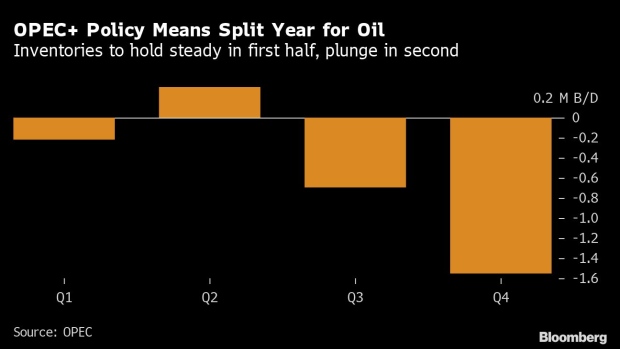

Saudi Arabia’s pledge that OPEC+ will hold oil supplies steady is setting up global oil markets for a year of two contrasting halves.

Saudi Energy Minister Prince Abdulaziz bin Salman, speaking in Riyadh this week, vowed that the producer group will stick firmly to current output quotas. “The agreement that we struck in October is here to stay for the rest of the year, period,” he said.

If the Organization of Petroleum Exporting Countries follows through on the plan, global oil markets will be distinctly divided this year. Supply and demand will be fairly balanced in the first half before swinging to a deficit in the second, the group’s data suggest.

Brent crude has dipped 3% since the end of 2022 to below $83.50 a barrel. Yet commodity analysts including those at Goldman Sachs Group Inc. and Morgan Stanley see it rising to $100 later this year.

World oil consumption is expected to remain subdued in the first six months of 2023 amid lingering fears of recession, but then pick up as China’s economic reopening gathers pace and stimulates other Asian economies.

The 23-nation OPEC+ coalition, led by Saudi Arabia and Russia, will have a chance to reconsider output policy when it gathers at the group’s headquarters in Vienna in early June.

©2023 Bloomberg L.P.