Oct 4, 2023

Ozempic Is Causing ‘Slight Pullback’ by Shoppers, Walmart Says

, Bloomberg News

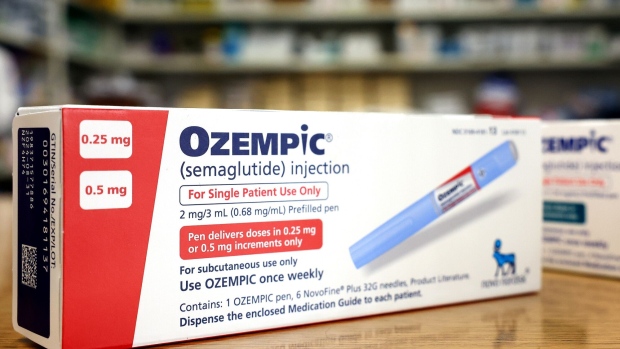

(Bloomberg) -- Walmart Inc. says it’s already seeing an impact on food-shopping demand from people taking the diabetes drug Ozempic, Wegovy and other appetite-suppressing medications.

“We definitely do see a slight change compared to the total population, we do see a slight pullback in overall basket,” John Furner, the chief executive officer of Walmart’s sprawling US operation, said in an interview Wednesday. “Just less units, slightly less calories.”

The Bentonville, Arkansas-based retailer is studying changes in sales patterns using anonymized data on shopper populations. It can look at the purchasing changes among people taking the drug and can also compare those habits to similar people who aren’t taking the shots. Furner said it’s too early to draw any definitive conclusions about the appetite-suppressing drugs made by Novo Nordisk A/S, and similar medicines.

An increasing number of CEOs and investors are talking about how popular weight-loss drugs might change the economy and business. Earlier this week, the CEO of the maker of Pringles and Cheez-Its said the company is studying their potential impact on dietary behaviors.

“Like everything that potentially impacts our business, we’ll look at it, study it and, if necessary, mitigate,” Steve Cahillane, the CEO of Kellanova, said in an interview.

Read More: Weight-Loss Drugs Linked to Higher Risk of Stomach Issues

Walmart sells GLP-1 drugs, a category that includes Ozempic, through its pharmacies. In August, it said they were giving the retailer a revenue boost. US sales for those medicines increased 300% between 2020 and 2022, according to a recent report from Trilliant Health.

“We still expect food, consumables, and health and wellness primarily due to the popularity of some GLP-1 drugs to grow as a percent of total in the back half,” Walmart CEO Doug McMillon said on a call with analysts in August.

There are other potential positive effects on sales as well, Chief Financial Officer John David Rainey said at the time. Customers taking weight-loss drugs “tend to spend more with us overall” even as they buy less food, Rainey told CNBC.

(Updates with CFO comment in final paragraph.)

©2023 Bloomberg L.P.