Nov 14, 2018

Pan American Agrees to Buy Silver Miner Tahoe for $1.1 Billion

, Bloomberg News

(Bloomberg) -- Pan American Silver Corp. agreed to buy Tahoe Resources Inc. for at least $1.07 billion in a cash and stock deal, sending the shares in the embattled precious-metals mining company soaring.

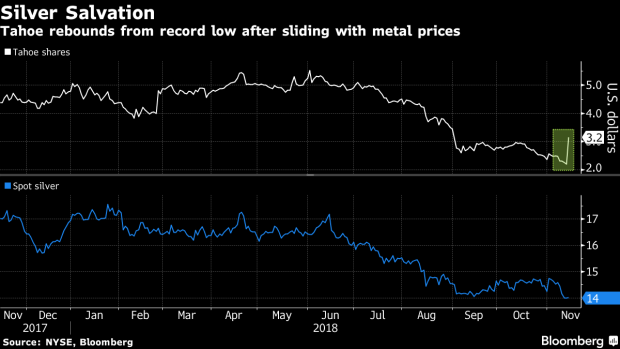

Reno, Nevada-based Tahoe climbed 46 percent as of 9:49 a.m. in New York from a record low on Tuesday. Tahoe has been struggling in the past year as its efforts to restart its flagship mine in Guatemala have dragged on amid a dispute over indigenous rights in the Central American country.

The Pan American purchase agreement represents about a 35 percent premium to Tahoe’s volume-weighted average price for the 20 days through Nov. 13, according to a joint statement from the companies Wednesday.

“Where the market sits right now, it’s the right time to do deals,” said Michael Steinmann, chief executive officer of Vancouver-based Pan American Silver. “It’s very hard to find high-quality silver assets.”

The deal, which would create the world’s largest publicly traded silver-mining company by free float, comes as declining prices for the metal have helped erode precious-metals explorers’ shares. On Wednesday, silver dropped below $14 an ounce to trade near its lowest since 2009, as a strong dollar and rising U.S. interest rates dent its appeal.

The agreement immediately drew criticism from one analyst on a conference call to discuss the plan, given Tahoe’s weakened share price.

“Why did you choose to sell out now?” John Tumazos, founder of John Tumazos Very Independent Research, asked Tahoe management during the call. “Why not hold out for six or 12 months for a better moment or a better option?”

Tahoe’s chairman acknowledged the concern on the call.

“We know that there would be questions as to why we would sell at what looks like an all-time low, and this was a big concern of ours, of course, and the board and the special committee,” Kevin McArthur said.

Tahoe has been beset with troubles at its flagship Escobal mine in Guatemala. In 2017, the country’s Supreme Court suspended the miner’s operating license, amid a dispute over whether an indigenous population was properly consulted before Tahoe’s subsidiary was granted permits for the site.

As Tahoe rose, Pan American Silver fell 10 percent to $12.72 in New York. The shares have declined 19 percent this year.

--With assistance from Joe Richter.

To contact the reporter on this story: Danielle Bochove in Toronto at dbochove1@bloomberg.net

To contact the editors responsible for this story: Luzi Ann Javier at ljavier@bloomberg.net, Steven Frank

©2018 Bloomberg L.P.