Jan 25, 2024

PayPal Has Analysts and Traders Divided as CEO Promises ‘Shock’

, Bloomberg News

(Bloomberg) -- Analysts are throwing in the towel while some investors are positioning for stock gains in PayPal Holdings Inc. ahead of an event Thursday at which the company is expected to showcase its innovations.

At least four analysts have downgraded the stock this month, citing a range of concerns from rising competition to pressure on profitability. Even Citigroup, which has a buy rating on PayPal shares, opened a negative catalyst watch ahead of earnings in February.

Chief Executive Officer Alex Chriss addressed Wall Street’s growing pessimism in an interview last week on CNBC. Chriss, who joined PayPal in September from Intuit, was greeted with a list of the downgrades: Mizuho on competition, Oppenheimer on profitability pressure, Morgan Stanley on slow progress while BTIG cited too much uncertainty.

“There hasn’t been a lot to celebrate over the last few years. Innovation has been slow,” Chriss responded. “I love being an underdog. I will take all of that feedback and we’ll shock the world.”

PayPal shares are wavering in Thursday trading in New York.

Until recently, Wall Street analysts had stood by PayPal despite the stock’s nearly 80% drop from a 2021 record amid slowing spending growth, disappointing forecasts and rising competition from competitors like Zelle and Apple Pay. Hold and sell ratings currently outnumber buys, with the average analyst recommendation sitting at the lowest since 2015 — the year PayPal debuted — according to data compiled by Bloomberg.

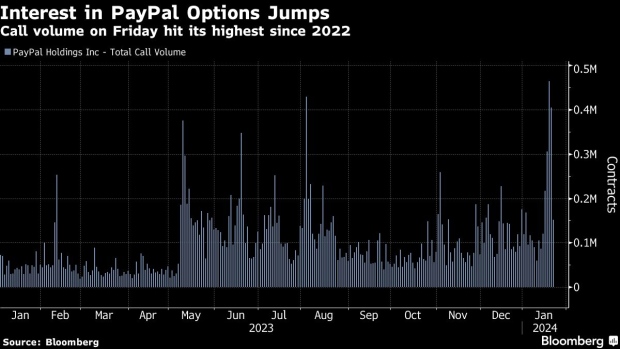

The analyst caution ahead of the event — touted as an “exclusive preview of the newest innovations” — and earnings scheduled for early February, is in direct contrast to market bets that there’s upside for PayPal shares in the near term. On Friday, investors traded the largest number of calls — which position for advances in the underlying stock — since February 2022.

The most active contracts expire on January 26, thus capturing any share moves that follow the event. Since early Monday, the cost of puts expiring Friday that protect against a 5% dip has risen less than the equivalent calls, signaling investors are more concerned with a share rally.

“It does look like a lot of speculative upside call flow,” said Bret Kenwell, a US options investment analyst at eToro Group Ltd. “This event — or floating the idea of AI, which is kind of a buzzword — gets the speculative engine going a little bit.”

Investors also gave Chriss’s remarks last week a nod of approval. The stock did a U-turn during his comments on CNBC and rallied to its best three-day winning streak in more than a year. PayPal has now gained 25% from an October low.

Brian Frank, president of Frank Capital Partners LLC, is among PayPal shareholders hoping for big news on Thursday. He’s been buying shares at current levels on what he sees as an attractive valuation after holding the stock “painfully for the last two years.”

PayPal is priced at about 11 times projected earnings, about half that of the Nasdaq 100 at about 25 times.

Read More: PayPal Bought Too Much, Will Focus on Profitability, CEO Says

One analyst that recently downgraded PayPal may also be holding onto some hope that the company can right itself.

“Obviously when you use the phrase ‘shock the world,’ I hope they have something really game-changing to report coming up,” said Oppenheimer’s Dominick Gabriele, who downgraded the stock to perform from outperform this month for the first time since he launched coverage in 2021.

“I’ve always liked this business a lot. It was hard to downgrade it. If things start turning around, we’ll be with them on the other side,” he said.

Tech Chart of the Day

Tesla Inc. has been the worst-performing member of the 10 largest stocks in the world — and its results Wednesday are set to further weaken the electric-car maker’s standing in the group. If losses hold, the firm is poised to shed more than $50 billion of market cap on Thursday.

Top Tech News

- Apple Inc.’s iPhone was the top-selling smartphone series in China for the first time last year, a surprisingly strong showing in the face of fierce local competition and expanding government prohibitions against the American company’s technology.

- A secret agreement between the US and the Netherlands last year to limit ASML Holding NV’s deliveries to China didn’t stop a surge in sales of its sensitive chipmaking equipment.

- Shein investors are trying to sell shares in private market deals that value the online fashion giant at as low as $45 billion, reflecting dwindling appetite for a company struggling with intensifying competition and regulatory scrutiny ahead of a long-awaited US debut.

- STMicroelectronics NV’s sales outlook for the current quarter missed estimates in a sign that weak demand for industrial chips is set to continue.

- SK Hynix Inc. posted its first operating profit in more than a year and affirmed plans to build high-end memory capacity to meet AI demand, the latest to signal hope for a long-delayed rebound in 2024.

Earnings Due Thursday

- Premarket

- Xerox

- NetScout

- Comcast

- Postmarket

- Intel

- Western Digital

- T-Mobile

--With assistance from Subrat Patnaik and Rheaa Rao.

(Updates stock moves at market open)

©2024 Bloomberg L.P.