Jan 29, 2019

PG&E files for bankruptcy setting stage for major restructuring

, Bloomberg News

PG&E Corp. (PCG.N) and its Pacific Gas & Electric Co. utility filed for Chapter 11 bankruptcy in a defensive maneuver that sets the stage for a major restructuring of California’s largest utility. The shares rose.

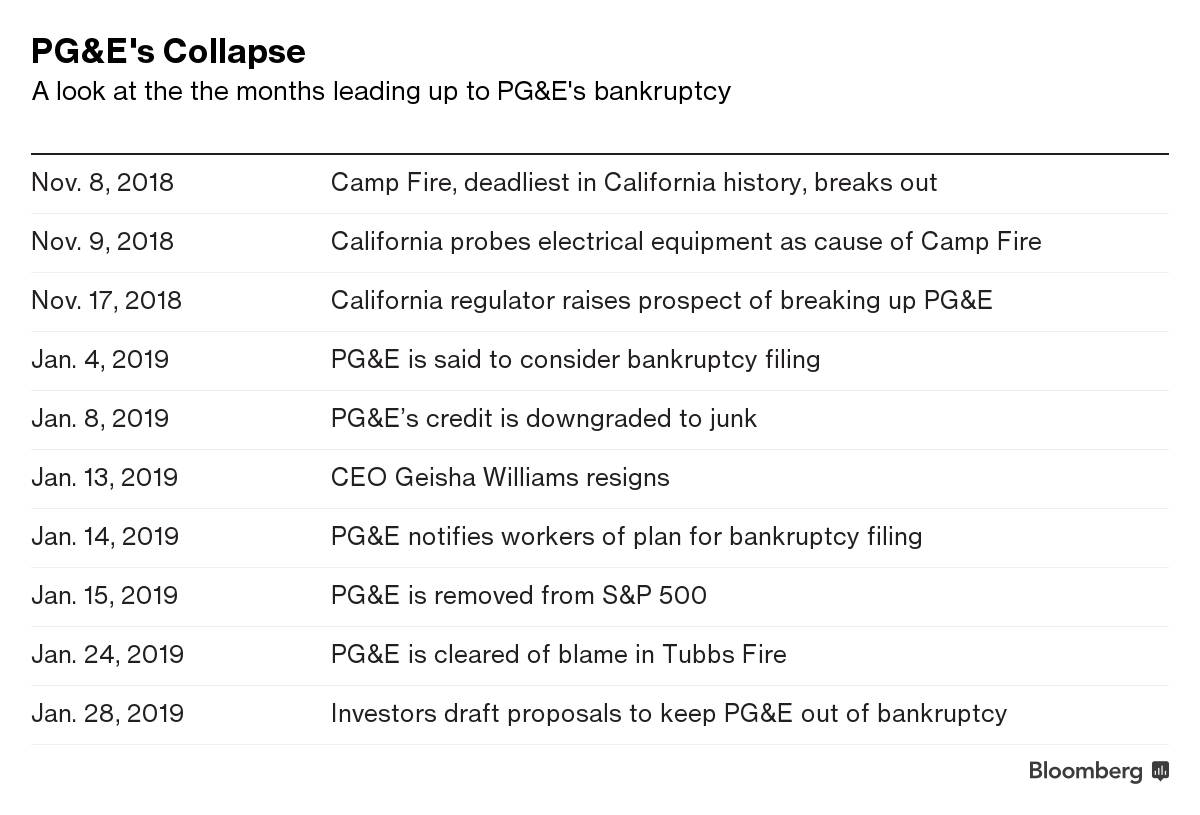

A series of wildfires that killed more than 100 people and scorched hundreds of thousands of acres in California over two years brought the utility to its knees. Since the November Camp Fire, the deadliest in state history, about three-quarters of PG&E’s market value has disappeared, its chief executive officer has left, its bonds have plunged and estimates of its liabilities have swelled to more than $30 billion.

The filing, which listed US$51.7 billion in total debts and US$71.4 billion in assets. allows the company to keep operating while it works out a plan to turn the business around and pay off creditors. A bankruptcy, and potentially a sale, may represent the best way for lawmakers and regulators to “remake the public face of the company for customers,’’ said Katie Bays, a Washington-based analyst at Height Securities LLC.

The utility’s issues “are long-running and structural," Bays said by telephone. "If PG&E cannot do this, if they cannot reform their safety culture on their own, they maybe need a new leader to come in there and achieve fundamental reforms.’’

The shares rose as much as 8.8 per cent in New York, reflecting a view that there’s still value in the company. “Their equity value has not been wiped out,’’ Bays said. “This bankruptcy is a math problem where the equity portion of that math problem is not necessarily a zero.”

While the company’s been cleared of fault for the Tubbs blaze, the wildfire that devastated California’s wine country in 2017, investigators have tied PG&E’s equipment to more than a dozen of the other fires. They’re looking at PG&E’s power lines as a possible ignition source for the Camp Fire, which killed 86.

“We did not make this decision lightly,’’ PG&E’s interim chief executive officer, John R. Simon, said in a letter to customers. “The power and gas will stay on. We will continue to provide you with reliable electric and natural gas service, and that will not change as a result of this process.’’

California’s wildfires have in the past saddled utilities with millions of dollars in damages, but never have the blazes exacted such a massive financial toll from a company -- creating one of the country’s largest utility bankruptcies of all time.

PG&E said it had about US$840 million of insurance coverage for liabilities, including wildfires, for the year starting Aug. 1, 2017. It renewed that wildfire-related liability insurance coverage for the year starting Aug. 1, 2018 in the aggregate amount of US$1.4 billion.

The only time the company has ever faced such dire financial straits was during the 2001 energy crisis, when it was forced to place its utility unit in bankruptcy protection. In a twist, the same judge who oversaw the company’s last Chapter 11 filing, Dennis Montali, has been assigned to the latest.

The utility giant’s financial crisis had some of the biggest names in the investment world working up last-minute financing packages that they said would have rescued the company from insolvency.

Temporary financing “would not have addressed the fundamental issues facing PG&E,’’ the company said in court documents. Meanwhile, PG&E said it saw no prospect of legislation to help it manage liabilities from the fires.

The utility’s top creditors include Bank of New York Mellon Corp., Citibank, Mizuho and Bank of America Corp. Bank of New York Mellon holds the largest unsecured claim, totaling US$3 billion, court filings show. The first meeting of creditors has been set for Feb. 26.

PG&E’s demise serves to underscore the increasing vulnerability utilities face to natural disasters such as wildfires and hurricanes that are becoming more extreme. That’s especially the case in California, where state law holds utilities liable for damages even if they aren’t found to be negligent.

State officials including Governor Gavin Newsom had said it would be in the state’s best interest to keep the utility healthy and financially viable. PG&E is considered a linchpin in helping achieve California’s ambitious climate goal of getting all its electricity from carbon-free sources by 2045. At the same time, Newsom chose not to take measures drastic enough to avoid a bankruptcy filing, and regulators actually began a process to evaluate whether to break up or take over the utility.

A bankruptcy will probably result in higher bills for customers because it will be more expensive for PG&E to borrow the money it needs to make infrastructure investments. The company supplies natural gas and electricity to about 16 million people in Northern and Central California.

As part of the bankruptcy, PG&E is seeking approval from the court to enter into an agreement for US$5.5 billion in debtor-in-possession financing. That would free up the capital it needs to keep operations going through the Chapter 11 process. It listed JP Morgan Chase & Co., Bank of America, Barclays Plc, Citigroup Inc., BNP Paribas SA, Credit Suisse Group AG, Goldman Sachs, MUFG Union Bank and Wells Fargo & Co. acting as joint lead arrangers.

Setting the stage for a potential battle over power contracts, PG&E has asked the judge to rule that the court has the exclusive right to reject existing power purchase agreements. NextEra Energy Inc. is fighting to keep its contracts with PG&E from being canceled as part of the bankruptcy and took up the issue with the Federal Energy Regulatory Commission last week. The commission asserted in response that it shares “concurrent jurisdiction” with bankruptcy courts.

Here are other highlights from the bankruptcy filing:

PG&E says it intends to pay suppliers in full under “normal terms.” Weil, Gotshal & Manges LLP and Cravath, Swaine & Moore LLP are PG&E’s legal counsel. Lazard is its investment banker and AlixPartners LLP is the restructuring adviser. James A. Mesterharm, a managing director at AlixPartners, will serve as PG&E’s chief restructuring officer. John Boken, also a managing director at AlixPartners, will be deputy chief restructuring officer. The first-day hearing on the bankruptcy hasn’t yet been scheduled.