Apr 3, 2024

Pimco Boosts Bond Bets That Fed Will Cut Less Than Global Peers

, Bloomberg News

(Bloomberg) -- The time is ripe for bond-market bets that the Federal Reserve will lower interest rates less than other major central banks in the next couple years, says Andrew Balls at Pacific Investment Management Co.

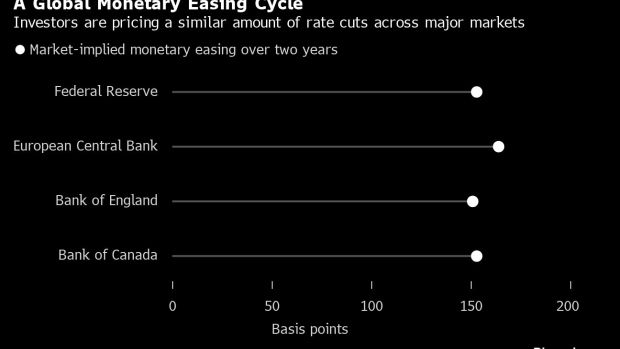

Global rates traders currently anticipate a uniform degree of policy easing across most developed nations in that period, totaling around 150 basis points each from the Fed, the Bank of Canada and the Bank of England, with a little more seen from the European Central Bank and the Reserve Bank of New Zealand.

But Pimco is positioning for the policy paths to diverge, with the Fed likely to deliver fewer cuts. That’s in large part because of key differences in the various home-loan markets. In a nutshell, fixed-rate mortgages are more prevalent in the US, which allowed borrowers to lock in historically low rates early in the pandemic, cushioning the world’s biggest economy against the Fed’s aggressive tightening cycle.

The asset manager’s $14.2 billion International Bond Fund is geared for more easing outside the US, in economies where floating-rate home loans are more typical, meaning higher borrowing costs will weigh more heavily on growth and inflation in the next two years.

“The common theme in a bunch of countries is that mortgage markets are much more amenable to a quicker pass-through” to their economies from rate hikes, said Balls, the firm’s chief investment officer for global fixed income.

He and fellow portfolio manager Sachin Gupta said in an interview in London last week that they favor the debt of the UK, Australia, New Zealand, Canada and Europe versus the US, and they’ve been adding to the trade, which can involve either front-end rates or the 10-year maturity. Pimco oversees $1.9 trillion overall.

High Conviction

“It makes a lot of sense to do these relative-value positions” between the US and other sovereign markets, Balls said. “It’s been working quite well,” and “I would say that the conviction level is certainly higher than it has been.”

The Pimco International Bond Fund has gained 1.3% this year through April 1, beating its benchmark and most peers, data compiled by Bloomberg show. The fund, which Balls and Gupta co-manage with Lorenzo Pagani, has also outperformed on a one-year basis.

Traders have already gotten burned trying to anticipate when central bankers would pivot to easing as sticky inflation led authorities to keep rates elevated. Late last year, for example, markets were betting on six Fed cuts in 2024. Fast forward, and investors are even doubting whether the Fed will be able to deliver on its projection of three total reductions by year-end.

For now, there’s broad uniformity across global markets that June is a potential kickoff point for central banks’ easing cycle.

As Pimco sees it, that consensus looks vulnerable given the differing economic outlooks.

To some extent markets are pricing “off the US curve,” Gupta said. “A bunch of countries are pricing in 150 to 170 basis points of cuts and it’s identical more or less, while there is vulnerability on the growth side.”

In the US, the Atlanta Fed estimates the economy is expanding at 2.8% annual pace. That compares with half a percent or weaker for Europe, Gupta said.

The inflation story is crucial for central banks and bond positioning. Treasuries sold off to start this week as the perceived probability of Fed easing as soon as June waned to a bit better than a coin toss after solid data. Traders have trimmed expectations for US rate cuts this year to a bit below the Fed’s current estimate of 75 basis points in total.

Speaking Friday when markets were closed, Fed Chair Jerome Powell reiterated that officials need greater confidence that inflation is easing before they start easing.

As far as rate cuts goes, “it seems more likely the US would under-deliver in the near-term versus the rest of the world, where it looks reasonable they over-deliver,” Balls said.

“The US still needs to see the slowdown in activity, whereas elsewhere in the world, we’ve seen this slowdown,” he said.

Pimco’s latest “cyclical outlook” released Wednesday and written by economist Tiffany Wilding and Balls, reiterated the message of US exceptionalism and diverging central bank policy paths, while affirming the attraction of elevated yields on bonds and mortgages.

Pimco’s other views for the next six to 12 months include:

- “Expect a more normal pattern of negative correlation between bonds and equities to reassert itself, with the potential for fixed income to outperform in the event that the pricing of recession risk rises again.”

- Intermediate-dated bonds “offer attractive yields along with potential price appreciation.”

- The belly of the curve is also “compelling at a time when cash yields are poised to fall if central banks cut rates from current elevated levels”

- Pimco has “an underweight view toward the long end of the US curve due to concerns about fiscal policy and Treasury supply.”

- UK bonds are “attractive given current valuation, an improving inflation picture, and the potential for the Bank of England to deliver more cuts than are currently priced into markets.”

- In Canada, “the balance of risks skewed toward greater central bank easing compared with current market pricing given an improved inflation outlook.”

- They “prefer the US dollar over the euro and other European currencies such as the Swiss franc and the Swedish krona, anticipating further US economic exceptionalism.”

(Adds Pimco’s latest cyclical outlook in last paragraph and bulleted section.)

©2024 Bloomberg L.P.