Feb 28, 2024

Private Credit Firms See More Asia Growth as Banks Retreat

, Bloomberg News

(Bloomberg) -- Some of the world’s biggest private credit firms see a further increase in Asia-Pacific lending in 2024 and are training their sights on higher-quality borrowers rather than on distressed cases.

A Bloomberg survey, which included Apollo Global Management Inc. and Blackstone Inc., found that several respondents expect the market to grow more than 10% this year. The interest in solid companies with a healthy cash flow comes as banks, who’ve long provided the backbone of financing for the region’s companies, pull back.

The education, healthcare, and consumption-related sectors are seen as the most promising for deals, according to the poll of nine companies, which was conducted in January and February.

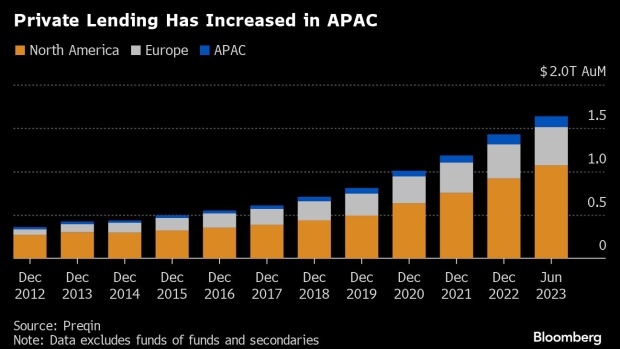

The $1.7 trillion global private credit market has become a serious rival to mainstream lending, attracting investors by offering higher, floating rates of return. While the Asia-Pacific share of assets is just a fraction of that sum, the rate of growth has outpaced that of other regions. Goldman Sachs Group Inc. recently clinched $1 billion from Abu Dhabi sovereign wealth fund Mubadala Investment Co. to scour for more private credit deals in Asia.

“Private credit has become an important source of financing in the leveraged loan markets in the US and Europe, and we expect Asia to follow the same trend,” said Mark Glengarry, head of Asia-Pacific for Blackstone Credit.

An anticipated increase in mergers and acquisitions will drive demand for private credit, according to responses from Apollo, Metrics Credit Partners Pty Ltd. and Revolution Asset Management.

“Asia, if taken as a whole, is under-levered,” said Brian Dillard, head of Asia credit at KKR & Co. “We think there’s a real gap for either stretching senior-secured leverage deeper in the capital structure or for providing more of a mezzanine solution.”

Demographic shifts in the region, such as the fast-growing middle class in places like India and Vietnam, will also drive capital flows. An aging population will boost demand for healthcare, a sector deemed attractive for 2024 by respondents.

More household spending is expected to benefit consumer businesses, including schools and technology as economies rebound from the pandemic. The energy transition sector will also see more activity, according to Blackstone and Allianz Global Investors.

While economies suffered during Covid-19 lockdowns, “now obviously, we’re coming out of that period and people are looking to expand their business,” said Sumit Bhandari, lead portfolio manager responsible for Asia private credit at at AllianzGI.

Private credit assets under management in Australia hit a record of about A$188 billion in 2023, according to Ernst & Young LLP. Growth is expected to continue, with some of the respondents, including Apollo, seeing opportunities in real estate.

Respondents were cautious on China, which is in the throes of an economic slowdown. Geopolitical tensions are also concerns.

“Some markets are open economies and thus they’re very trade dependent and export oriented,” said Edward Tong, managing director at HPS Investment Partners. “Those are fairly sensitive to macro developments globally.”

--With assistance from Davide Scigliuzzo and Lynn Thomasson.

(Updates with quote in 9th, state of Australia market in 10th paragraphs)

©2024 Bloomberg L.P.