May 16, 2023

Production at US Manufacturers Rebounds After March Slump

, Bloomberg News

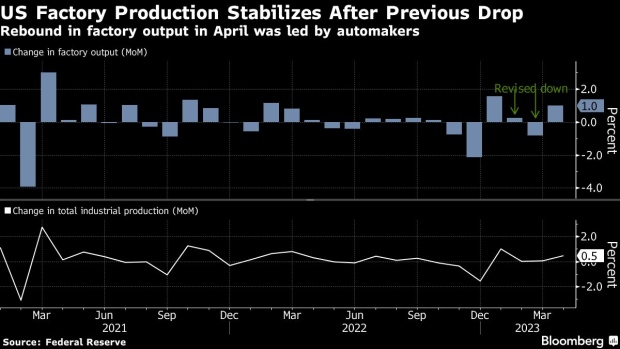

(Bloomberg) -- Production at US factories rebounded in April, led by a firm advance at automakers and suggesting some stabilization in goods demand.

Manufacturing output rose 1% last month after downward revisions to the prior two months, Federal Reserve data showed Tuesday. Including mining and utilities, total industrial production increased 0.5%.

The gain in factory output reflected a 9.3% jump in motor vehicle production as well as increases for primary metals, computers and electronic products, and chemicals.

The gain in auto production was the largest since October 2021. Vehicle assemblies totaled an annualized 11.4 million last month, the strongest since July 2020.

Still, the manufacturing sector, which was already facing a range of headwinds, is coming under increasing pressure amid tightening financial conditions, weaker goods demand and an uncertain outlook. At the same time, factories are enjoying some relief from stability in supply chains and cheaper commodities.

Separate data has suggested that consumer spending on merchandise is holding up, with retail sales increasing in April and auto sales posting their strongest month in nearly two years.

Despite the advance in factory output, survey data suggest the sector is struggling to gain traction. The Institute for Supply Management’s factory gauge has indicated contraction for six straight months, and business equipment orders have fallen in back-to-back months.

Looking ahead, the picture is more mixed. A gauge of New York state manufacturing activity slumped in May by the most in more than three years, according to separate figures Monday, but factories were generally more optimistic about future business conditions.

The Fed’s report showed capacity utilization at factories, a measure of potential output being used, rose to 78.3%. Overall utilization edged up.

Utility output dropped 3.1% on the back of milder temperatures that lowered demand for heating. Mining increased 0.6%, led by oil and gas extraction.

--With assistance from Augusta Saraiva.

(Adds graphic)

©2023 Bloomberg L.P.