Oct 4, 2023

Quant Safety Trades Outperform as Credit Fears Start to Build

, Bloomberg News

(Bloomberg) -- Across the quant-investing landscape, Wall Street traders are starting to worry about the balance-sheet health of Corporate America just as blue-chip borrowing costs soar to the highest since 2009.

Companies with the weakest financial metrics are getting punished as a long-short trade tracking firms with the highest leverage reels from the worst day since May, after falling for two months in a row.

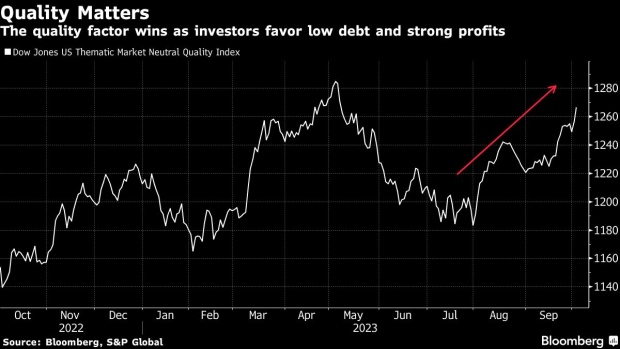

On the flipside, a rules-based trade that buys the most profitable names has just notched its best session since August following back-to-back months of positive returns, per Bloomberg data. An investing style that buys quality firms with low debt is continuing its winning spree this week after its best quarter this year, a Dow Jones index shows.

Even as the credit cycle powers on against bearish expectations, fresh evidence is emerging that investors are growing more concerned that the weakest stock links face punishing refinancing costs ahead as benchmark Treasury yields soar anew.

That’s adding fuel to defensive strategies that bid up low-indebted companies with a reputation for generating corporate profits across the monetary and economic cycle. Within the quality factor some of the big winners of late belong to the healthcare sector, while many of the losers include consumer discretionary firms.

“In a world where rates are rising in spite of growth, not because of growth, it makes sense to move up in quality,” said Steve Caprio, head of European and US credit strategy at Deutsche Bank AG. “Higher rates plus weaker growth plus leveraged capital structures is not a good tactical set up for risk.”

Traders are increasing their wagers that the Federal Reserve will hold interest rates at lofty levels for longer than anticipated, exerting fresh pressure on the equity and debt prices of companies big and small. The S&P 500 has wiped out four months of gains as spiking long-term yields undermine valuations for risk assets.

With all bets off on how the economy will withstand the latest bout of monetary tightening, quant and discretionary investors alike see good reason to favor large and mid-size companies with a high return on equity, low leverage and modest variability in earnings — traits associated with so-called quality equities.

“Higher for longer increases the odds of a recession in the next 12-15 months which makes quality attributes more valuable,” said Mathieu Savary, a strategist at BCA Research in Montreal. “Higher for longer also means that quality firms are likely to better withstand the effect of rates on their profits or balance sheets.”

While investors are increasingly making distinctions between losers and winners in this new era of higher rates, the S&P 500 is still up 10% year to date, thanks to the sturdiness of tech megacaps. Still while credit conditions have tightened, the broad impact has been “somewhat modest so far,” according to a team led by Aditya Bhave, a global economist at Bank of America Corp. One reason for optimism is that bank loan growth remains positive in most categories even if it’s not keeping up with economic growth, the note said.

Yet with corporate bankruptcies piling up, it may only be a matter of time before credit markets buckle, threatening a fresh rotation out of risk-on systematic trades in favor of safety.

“We are seeing limited signs of stress in the corporate debt market because we have had so far limited refinancing needs as maturities have been extended,” said Raphael Thuin, head of capital markets strategies at Tikehau Capital. “Many of those zombie companies which have stabilized because they used wide open capital markets and liquidity at zero costs will struggle.”

--With assistance from Justina Lee.

©2023 Bloomberg L.P.