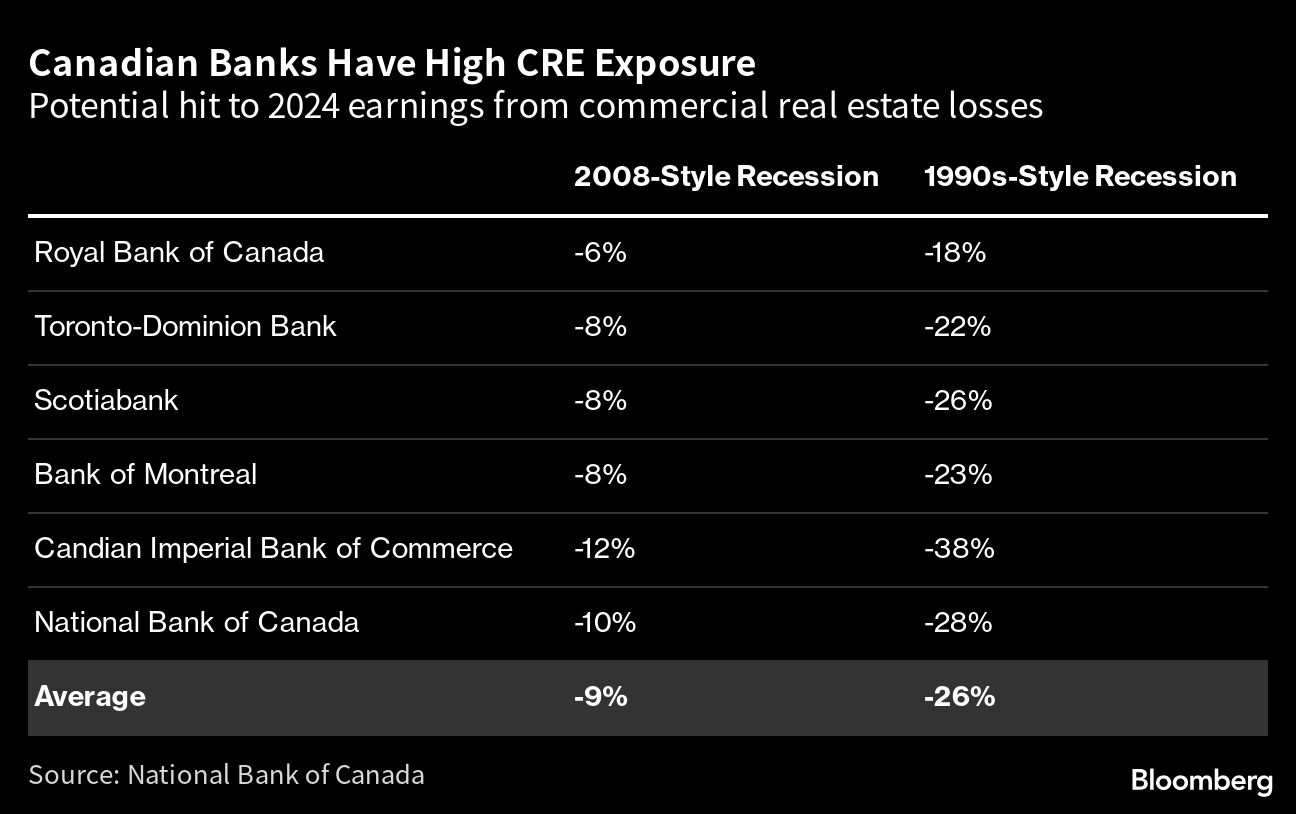

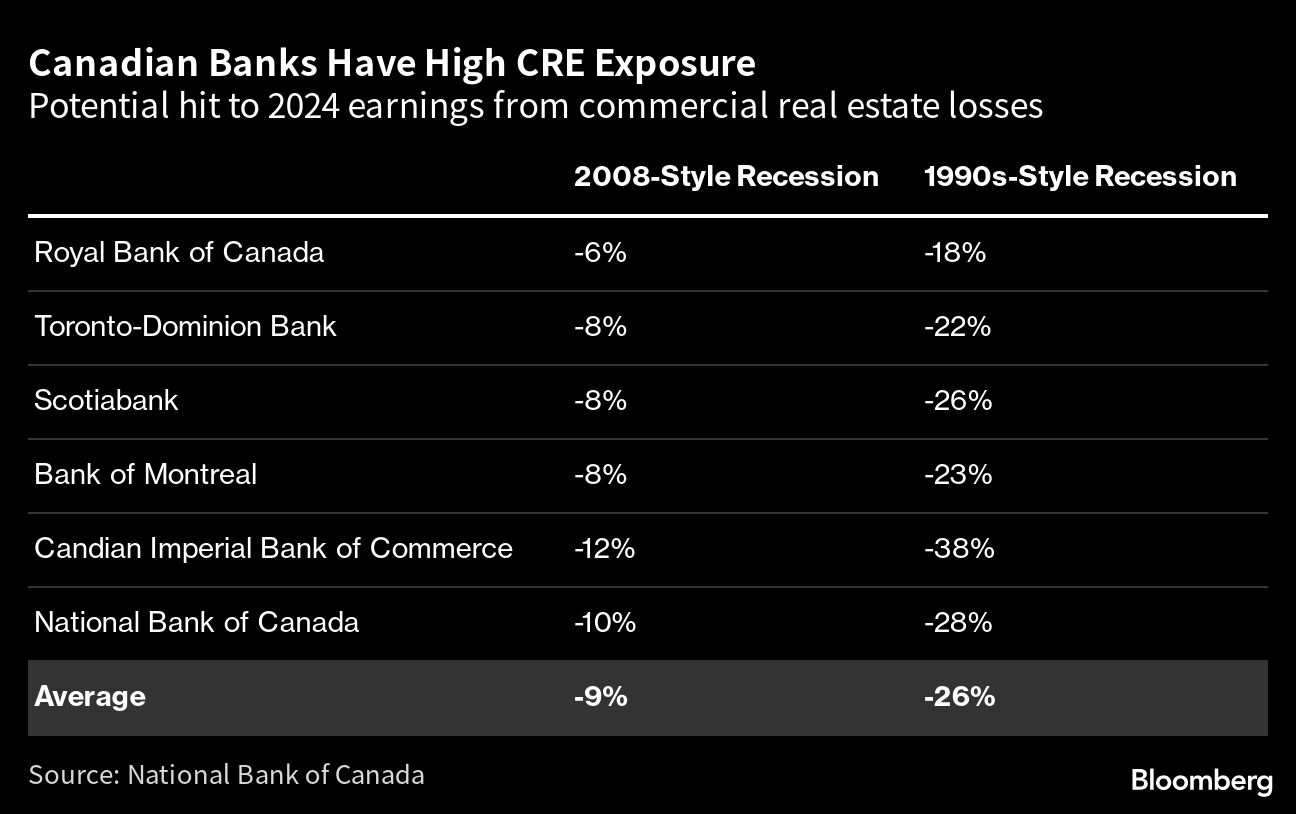

Canada’s largest banks could see their profits reduced by nine per cent next year if the commercial real estate downturn is similar to one seen during the global financial crisis, according to analysis by National Bank of Canada.

Commercial property represents about 10 per cent of the loan portfolios of Canada’s six largest banks, surpassed only by residential mortgages. In a 2008-style scenario, that exposure could force them to set aside about $6.3 billion in provisions for credit losses to the commercial real state sector, analyst Gabriel Dechaine calculated.

“Office exposures are the primary source of investor concerns,” Dechaine wrote, since occupancy rates are hovering around 50 per cent as many workers continue to spend large amounts of time at home. Gross impaired loans on commercial property are already on the rise — jumping by 8 basis points to 0.41 per cent during the fiscal first quarter ended Jan. 31, the analyst said.

Dechaine built two scenarios to assess the potential impact on bank profits. Worse than the 2008 scenario would be a depression similar to the one that struck Canadian real estate markets in the early 1990s. That would send impaired loans soaring into the tens of billions, chopping 26 per cent off next year’s earnings for the six biggest banks.

“While we argue that commercial real estate-related credit risks is lower on Canadian bank balance sheets, we also acknowledge that the mechanics of provision accounting could result in greater earnings volatility for the Big Six in a downturn scenario,” said Dechaine. Even in a 1990s scenario, banks’ capital ratios would stay above the minimum regulatory level, “or close enough,” he said.

Royal Bank of Canada and Toronto-Dominion Bank have the largest commercial real estate loan portfolios among Canada’s six largest lenders, while smaller Canadian Imperial Bank of Commerce and National Bank have the largest exposure as a percentage of their capital.