Oct 31, 2022

Record E-Trading Brings More Liquidity to Corporate Bond Market

, Bloomberg News

(Bloomberg) -- Electronic trading of corporate bonds has reached record levels, as credit-trading algorithms get smarter, grab market share, and make it easier for investors to buy and sell corporate bonds without affecting prices too much.

Banks, money managers and others on average traded $15 billion of company bonds electronically daily in September, according to a report from Coalition Greenwich, looking at both investment-grade and high-yield debt. That record level compares with a $12.7 billion daily average in 2021. For junk bonds, about a third of trading volume was through online platforms last month, up from about a quarter in the same period last year.

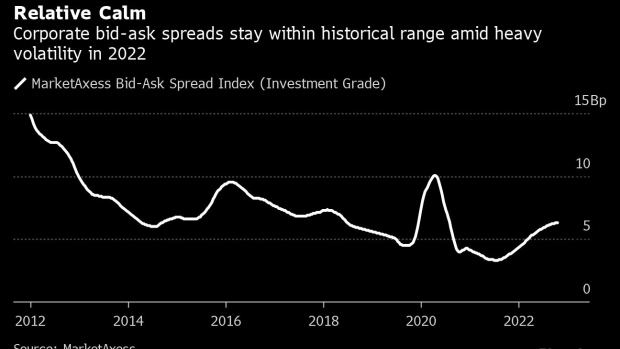

The growth of online trading has helped liquidity in the corporate bond market at a time when central banks are lifting rates, a situation that many investors have long feared would make trading all but impossible. A key measure of liquidity, namely the average difference between the price a dealer will pay to buy or to sell a security, is around 0.06 percentage point now. That’s in line with levels in 2018 and 2019, when interest rates were more stable.

“Absolutely I think the liquidity of investment-grade bonds relative to other asset classes has gone up this year,” said Travis King, head of US investment-grade corporates at Voya Investment Management, adding that electronic trading is part of the reason why.

Part of that is because of increasingly sophisticated algorithms that can price a growing list of securities without human input. Algorithms are helping with electronically-assisted portfolio trading, where investors can buy or sell large numbers of bonds in one fell swoop, aided by dealers who need to package bonds into exchange traded-fund shares or break ETFs down. King said these trades are a key support for liquidity.

On top of that, algorithms have been learning. Many algos struggled when debt markets melted down early in the pandemic, but patterns from prior movements have helped them get better at navigating tempestuous markets.

“As our algos have continued to get smarter, our investment-grade algo is trading twice the volume it was in 2020,” said Sonali Theisen, Bank of America Corp.’s global head of FICC e-trading and market structure.

Some investors say they have noticed that their options for selling securities quickly have improved markedly from even a year or two ago.

Tom Melvin, a senior high-yield trader at Invesco Ltd, said on a Coalition Greenwich e-trading panel this month that increased adoption of e-trading and better technology, combined with larger new issue deal sizes, is helping liquidity.

“We now have a more educated group of buyside traders, well-honed sellside shops with algorithmic trading, and cash traders squaring positions through the electronic market,” Melvin said. “I think it’s just going to keep going. I think we see numbers rise from here as deals get larger.”

Investment-grade electronic trading accounted for 42% of volume in September, up 9 percentage points from the same month last year, and high yield was 34%, up 10 percentage points, according to Coalition Greenwich’s report this month. Overall average daily volume for electronic and other trading was $35 billion, up 8% from September 2021.

Last month saw sharp price changes from day to day, and relatively high volume, Coalition Greenwich’s Kevin McPartland wrote.

“So how did traders keep up? By trading electronically more than ever before,” according to McPartland.

Elsewhere in the credit markets:

Americas

Five companies, including American Express Co. and Comcast Corp., lined up to sell bonds investment-grade market on Monday.

- Goldman Sachs Group Inc.’s private-lending arm and Sixth Street Partners are leading a group of direct lenders providing part of the $5.5 billion acquisition financing for Blackstone Inc.’s purchase of a majority stake in Emerson Electric Co.’s climate technology business

- Airlines that have racked up a lot of debt during the pandemic will be in trouble if interest rates continue to rise and demand for travel softens with the onset of a recession, said William Franke, chairman of discount carrier Frontier Group Holdings Inc

- Twitter Inc. launched an offer to buy back all of its outstanding bonds under a provision that allows investors to sell them back in the event of an acquisition

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Germany government-guaranteed KfW offered a €1 billion ($988.3 million) green bond.

- An abundance of events including central bank rate decisions, economic data and public holidays could hamper the week’s deal flow

- More than half of market participants in a Bloomberg News survey expect this week’s issuance to be at least €20 billion after previous weekly sales of €18 billion

- Non-financial corporate borrowers made up the majority of the issuance last week

- French embattled nursing home operator Orpea SA saw its debt losing as much as 80% of its face value

- Rising interest rates, inflation and recession risks have eroded consumer confidence and left buyout firms facing higher financing costs and potentially lower returns

Asia

Chinese dollar bonds are on pace for one of their weakest-ever months, with both high-yield and investment-grade notes sliding alongside the country’s currency and equities on continued economic uncertainty.

- Longfor Group Holdings Ltd’s dollar bonds slumped after the developer’s founder resigned as chairman

- On the domestic front, Shenzhen Municipality becomes the third Chinese local government in recent weeks to market CNH bonds

- Elsewhere, the South Korean government is pledging support to help ease burden on local credit market as borrowing costs soar

©2022 Bloomberg L.P.