Jan 27, 2021

Risk-Averse Thai Investors Clash With Central Bank’s Baht Goals

, Bloomberg News

(Bloomberg) -- The Bank of Thailand is scrapping obstacles for Thais to invest directly in foreign equities in an effort to stall the baht’s relentless rally, but will need to overcome locals’ traditional risk aversion for the program to succeed.

Regulatory changes include raising the cap on international stock and bond holdings and lifting some curbs on currency trading last November. The baht has strengthened 4.3% against the dollar in the past three months, making it Asia’s best performer but jeopardizing the recovery of Southeast Asia’s second-largest economy.

“I’ve always wanted to directly invest more abroad because there are lots of interesting companies in sectors like technology, rather than just banks, oil and property stocks as we have in Thailand,” said Watchara Kaewsawang, a Bangkok resident who manages more than 1 billion baht ($33 million) of his own assets. “I’ve tried, but time zone differences and regulations made me more cautious.”

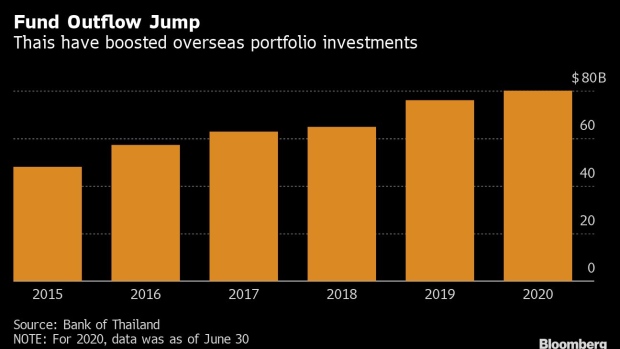

According to a recent central bank report, Thai investors -- including mutual funds, pension funds, insurance firms and individuals -- held a combined $80 billion of foreign securities as of last June 30, compared with $48 billion in 2015.

Some 37% of those assets were in fixed-income securities and 29% in mutual funds, half of which were bond-focused, the report said. Only 5% of Thai investment went directly into foreign equities, the central bank said.

Thailand has one of the highest home-bias investments for equities and bonds among Asian countries, trailing only Indonesia, according to a Bank of Thailand study. Risk aversion is a key reason why about 60% of Thai household savings were in bank deposits and domestic equities at the end of 2019, the report said.

The central bank bets its regulatory changes will prompt some reallocations, easing pressure on the baht. The opportunity in overseas markets may be lure enough, as Thai equities have consistently lagged foreign markets. The country’s benchmark SET Index is down 1.7% over the past 12 months, trailing about 17% return for the MSCI World Index.

“We’re seeing more individual clients becoming keen on increasing their overseas investments,” said Pornthep Jubandhu, head of research at SCB Asset Management Co., Thailand’s biggest private money manager with $52 billion of assets. “Still, Thais tend to prefer fixed-income securities, so even if they fully-hedge for foreign-exchange risk, more activity is unlikely to have much influence on the baht.”

The baht’s rally has been underpinned by expectations that vaccine roll-out will revive the tourism industry, which generates about one-fifth of Thailand’s gross domestic product. But a stronger currency can be an obstacle to exports of food, electronics and auto parts.

Credit Suisse Group AG, Julius Baer Group Ltd. and DBS Group Holdings Ltd. are among the international firms that have expanded their wealth-management operations in Thailand in recent years, betting that more Thais will want to diversify their portfolios.

The easing of overseas investment rules “now provides the avenue for Thai-domiciled clients to access an even wider array of investment solutions,” said Edwin Tan, head of investment & advisory solutions in Thailand for Credit Suisse Group AG.

But old habits are hard to change, especially amid a once-in-a-century pandemic.

Investor Watchara said he currently has 10% of his assets in stocks of individual foreign companies, which have outperformed his local holdings. He bought shares in Tesla Inc. last year, but recently sold them “to lock in some profit and avoid waking up late at night” to monitor the price.

Although the choices are greater overseas, he said he remains “comfortable” having most of his holdings at home, in companies and an environment he’s familiar with.

©2021 Bloomberg L.P.