Feb 20, 2024

Rivian Needs to Show It Can Stop Burning Cash as EV Demand Slows

, Bloomberg News

(Bloomberg) -- Rivian Automotive Inc. lost its claim to be Tesla Inc.’s most credible competitor long ago. Now, its ability to navigate an EV demand slowdown poses its biggest test.

With even auto industry stalwarts such as Ford Motor Co. dialing back their expansion plans, the top question for investors will be how an unprofitable, cash-burning startup can weather the storm. Markets will be seeking clarity when the Amazon.com Inc.-backed firm reports fourth-quarter results on Wednesday.

“At some point they will need to show that they can produce cars at scale and people will buy them,” David Mazza, chief strategy officer at Roundhill Investments, said in an interview. “If they cannot do that this quarter, then the stock will remain under pressure.”

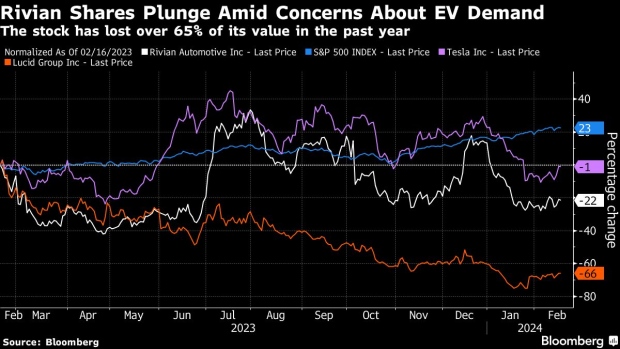

Shares of Rivian fell as much as 5.2% in intraday trading Tuesday, pushing its year-to-date slump to more than 30% even as the tech-heavy Nasdaq 100 and the broader S&P 500 Index have both jumped by around 4%. Wall Street’s plunging expectations for the company’s 2024 revenue suggest the slide may not stop any time soon.

Analysts’ average estimate for Rivian’s revenue for this year has fallen 43% over a 12-month period, data compiled by Bloomberg show. The average price target for the stock has dropped more than 35% over the same time.

The trouble is that Rivian, as well as other smaller EV-makers such as Lucid Group Inc., face broader industry weakness at a time when they are least equipped to handle it. These companies need to scale up production in order to start making profits, which in turn requires spending cash. But with even Tesla cutting vehicle prices to shore up sales, there are going to be few takers for expensive cars made by Rivian and Lucid.

“It appears that even great product and tech is not enough to avoid the EV winter,” said Barclays analyst Dan Levy last week, as he downgraded his recommendation on Rivian. “With demand now in question, it likely implies pressure to pricing — driving a tougher path to gross margin profitability,” Levy added.

Read More: The Big Miss on Electric Cars Is Remaking Europe’s Auto Industry

And lowering prices in order to compete with rivals like Tesla will make profits even more elusive.

The pace at which Rivian, or even Lucid, are spending cash is going to be crucial. Morgan Stanley analyst Adam Jonas estimates Rivian will use up $3.9 billion in research and development, and capital expenses this year. That translates to spending over $64,000 for every unit of vehicle it delivers — considerable when prices for Rivian’s pickup truck start at just under $70,000, while that for its SUV is around $94,000.

Rivian is estimated to sell about 66,000 vehicles in 2024, up from around 50,000 last year, while Lucid is expected to deliver about 12,000 units, compared to the 6,000 sold in 2023. Lucid will also be reporting quarterly results on Wednesday.

The fourth-quarter production and delivery figures reported by Rivian early in January signaled “overproduction on weakening EV demand as it ramps up plant capacity,” Bloomberg Intelligence analyst Steve Man said. Investors will be watching closely on how Rivian plans to tackle those challenges ahead.

“It is really going to be all about cost control,” Man added. “Rivian needs to spend prudently, but at the same time not lose sight of the fact that it needs to expand its product portfolio and production capacity.”

Tech Chart of the Day

Tomorrow’s Nvidia Corp. earnings are once again set to test the firm’s ability to meet consistently high expectations. Still, the stock has at least caught up with analyst price targets that only a few months ago looked to have raced to delirious heights. The firm’s market capitalization reached $1.8 trillion last week, surpassing that of Amazon and Alphabet Inc. and leaving analysts racing to set higher targets.

Top Tech News

- A key focus for investors will be how well Nvidia Corp. can keep capturing the growth for artificial intelligence.

- A year ago the crypto market was on its knees and the notion that Bitcoin might retest a record high of nearly $69,000 was almost risible. Fast forward 12 months and some studies now point to just that possibility.

- Stark Bank, one of the few Latin America startups to receive funding from Jeff Bezos’ family office, is generating profits from its business of helping companies handle payments, while leaving cash raised from its funding rounds nearly untouched.

- TikTok owner ByteDance Ltd. risks heavy European Union penalties under tough new content rules for Big Tech after regulators announced a formal investigation into its alleged failure to protect minors who use the video-sharing platform.

- China’s ruling Communist Party will play a bigger role in steering its vast technology industry, the latest sign that Beijing intends to exert more influence over swathes of the world’s No. 2 economy.

Earnings Due Tuesday

- Postmarket

- Palo Alto Networks

- Keysight

--With assistance from Subrat Patnaik.

(Updates stock moves at market open. A previous version corrected the chart sub-hed for Rivian’s decline over the past year.)

©2024 Bloomberg L.P.