Aug 4, 2021

Robinhood Retail Traders Join Cathie Wood to Get Stock Above IPO

, Bloomberg News

(Bloomberg) -- Robinhood Markets Inc. shares rose above the company’s initial public offering price for the first time as individual investors joined Cathie Wood on Tuesday to boost the zero-fee trading platform.

Retail investors’ participation in share trading saw a steep improvement on Tuesday compared to the lukewarm reception the popular app received since making its stock-market debut on Thursday. The trading boost came alongside Ark Investment Management’s move to increase stake in the company. Ark Fintech Innovation ETF bought 89,622 Robinhood shares in the previous session as they surged 24% to close at $46.80 apiece.

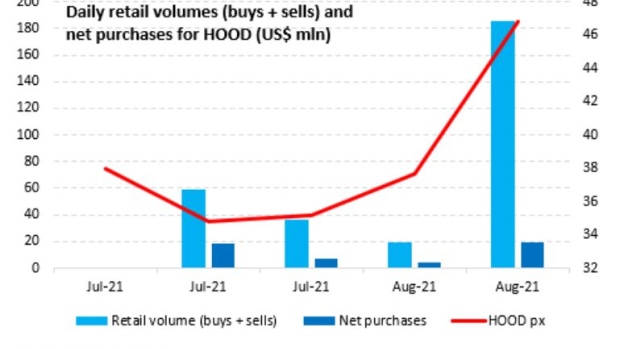

Retail traders bought net $19.4 million worth of Robinhood shares on Tuesday to make it the sixth-most-purchased stock and 11th-most-traded security on retail platforms, according to data compiled by Vanda Securities Pte. Total retail volume on Tuesday surged about 10-fold from the previous day, the data show.

Robinhood was the 28th most-traded security among retail investors in notional terms on the day it debuted, then dropped to 47th in the next session and fell out of the top 100 on Monday.

©2021 Bloomberg L.P.