Aug 15, 2022

Royal Caribbean Pays More Than 11% on Bond to Refinance Debt

, Bloomberg News

(Bloomberg) -- Royal Caribbean Group, buffeted by pandemic-related business obstacles, paid more than 11% on a $1.25 billion junk-bond deal following a rally in credit that’s provided an opportunity for companies to refinance debt.

The arrival of Covid-19 in 2020 shut down the cruise business, and Royal Caribbean loaded up on debt after the Federal Reserve slashed interest rates to help companies survive. Now the Fed is raising rates to stem inflation, and the cost of borrowing has increased broadly amid fears of a recession and geopolitical risks from the Russia-Ukraine war.

Cruise liners also have struggled with crew shortages, a slower return to pre-Covid leisure travel than expected, and higher fuel costs.

Some of Royal Caribbean’s existing bonds traded down following the announcement of the debt sale Monday. The company’s 5.5% notes maturing in 2028 fell more than a point to 81 cents on the dollar, according to Trace bond pricing data.

Pricing guidance decreased during the marketing process, down from an initial range of a low 12% yield, said a person familiar with the matter, who asked not to be identified because they’re not authorized to speak about it. While that’s typically a sign of investor demand, the final 11.625% coupon still marks a steep increase in the cost of borrowing.

The offering was also increased from $1 billion.

Royal Caribbean sold its last junk bond in January, a refinancing that saw costs decrease during the marketing process and wrapped up with a 5.375% coupon. Both the new deal and the January sale are unsecured and rated in the single-B band of credit ratings, the middle tier of junk.

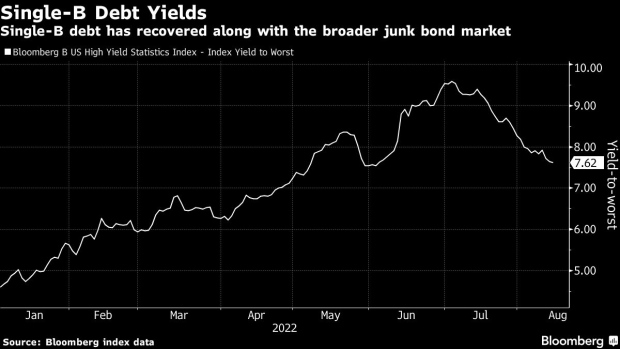

On average, yields on single-B rated junk bonds have increased to 7.6% from about 4.6% at the start of the year, according to Bloomberg index data. But they’ve fallen after a steady rally in the high-yield bond market since the end of June and an influx of cash into the asset class that’s created a window for companies to refinance.

Read more: Junk Borrowers Pounce on Fleeting Pre-Labor Day Financing Window

Refinancing Debt

Royal Caribbean tapped corporate debt markets throughout the pandemic and now has more than $23 billion in debt on its balance sheet as of June 30, 2022, according to its latest quarterly earnings filing.

Royal Caribbean’s new five-year unsecured notes, led by Bank of America Corp., will be used to repay principal payments on debt maturing in 2022 and 2023, as well as potentially borrowings under revolving credit facilities and other debt, according to the company’s news release.

Royal Caribbean also recently raised $1 billion of 6% convertible senior notes due 2025 earlier in August to repurchase $350 million senior notes due November 2023 and $800 million senior notes due June 2023.

©2022 Bloomberg L.P.