Dec 21, 2020

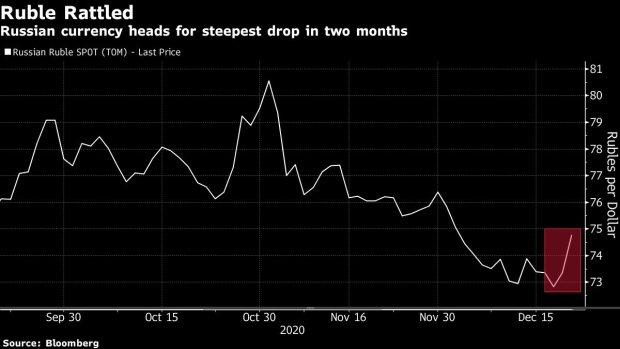

Ruble Drops Most in Nine Months on Tumbling Oil, Sanctions Woes

, Bloomberg News

(Bloomberg) -- Russia’s ruble fell the most since March as oil tumbled on concern the pandemic is worsening and a report suggested the U.S. may impose sanctions on the country in response to cyber attacks.

The currency of the world’s biggest energy exporter led its emerging-market peers lower as Brent crude slumped after a faster-spreading mutation of the Covid-19 virus was detected in the U.K. Russian bond yields climbed to the highest level since early November after Reuters said U.S. President-Elect Joe Biden was weighing sanctions and other measures in response to an alleged Russian hacking campaign.

“The Russian ruble is the main victim of rapidly escalating risk aversion,” said Piotr Matys, a strategist at Rabobank in London. “In addition to rising tensions between the U.S. and Russia over allegations of a cyber attack, the markets are also concerned about the latest developments in the U.K.”

The ruble was 2.2% weaker at 75.0075 per dollar as of 11:38 a.m. in Moscow after tumbling as much as 3.3%. Monday’s losses trimmed the currency’s advance this month to 2.1%. MSCI Inc.’s gauge of emerging-market currencies fell 0.3%, set for the biggest one-day loss since Nov. 19. Ten-year bond yields climbed two basis points to 5.87%.

The ruble had rallied since the U.S. election in early November as concern about possible penalties from the incoming Biden administration eased. However, the market mood shifted last week as the hacking reports brought the prospect of tougher sanctions back to the fore.

©2020 Bloomberg L.P.