Mar 14, 2024

Russia Oil Revenue Falls As Some Buyers Shun Its Crude, IEA Says

, Bloomberg News

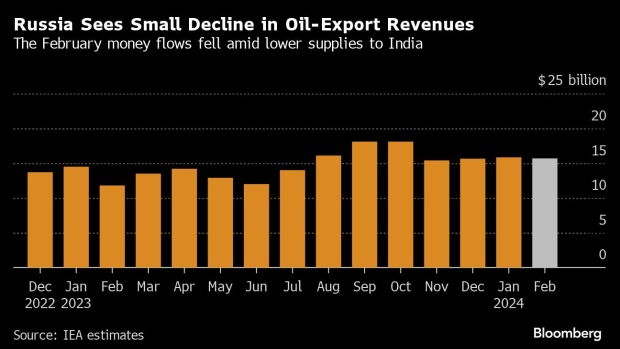

(Bloomberg) -- Russia’s oil-export revenue declined in February as tougher monitoring of western sanctions against the Kremlin reduced some buyers’ appetite for the nation’s barrels, according to the International Energy Agency.

The top-three global oil producer earned $15.69 billion from crude and petroleum product exports last month, down 0.95% from January, the Paris-based agency said in its monthly oil report on Thursday.

While Russia’s petroleum-product exports stayed flat in February, its crude shipments fell to 4.75 million barrels a day, compared with the December peak of 5 million barrels a day, the IEA said.

The decline in Russian crude flows abroad was mainly driven by India, which reduced its purchases of Russian crude barrels by 420,000 barrels a day in February compared to the month before, the IEA said.

“The impact of lower crude export volumes was only partially offset by higher product export prices,” the agency said.

Russia is the single-largest oil supplier to India as the South Asian nation is taking advantage of cheaper barrels that are subject to import bans in western nations. However, in the recent months the US and its allies have toughened monitoring of the global compliance with their energy sanctions against the Kremlin, and now Indian refineries are looking to buy more from competing producers such as Saudi Arabia.

Read More: India Cautious on Contracted Russian Oil as US Sanctions Bite

India’s caution has created a backlog of tankers loaded with Sokol, a Russian crude export grade, off the shores of Singapore and South Korea. At its height, the stranded oil volumes amounted to as much as 18 million barrels and the backlog has started to clear only recently when Chinese refineries purchased some Sokol cargoes.

Russia’s February crude loadings for China jumped to 2.2 million barrels a day, in line with the recent November peak, according to the IEA. The recorded month-on-month growth was only 100,000 barrels a day, the agency said, pointing out that the actual deliveries may be higher as some 350,000 barrels of the daily export flows have no fixed destination yet and may head to Chinese buyers.

©2024 Bloomberg L.P.