Mar 4, 2022

Russian Economy Staggers Into 1998 ‘Times Three’ With Foreign Exodus

, Bloomberg News

(Bloomberg) -- The international isolating of Russia is leaving local businesses flailing as foreign firms head for the exits, helping to drive the economy deeper into recession.

Besieged by international sanctions over President Vladimir Putin’s invasion of Ukraine, the world’s 11th-largest economy is suffering a rash of departures by multinational companies in industries as varied as car manufacturing, sporting goods and consumer appliances.

For those firms’ erstwhile Russian partners, the only choice is to retool on the fly in the hope of staying in business. Ikea, Renault SA, Apple Inc., Nike Inc. and Royal Dutch Shell Plc are among those to have pulled back.

At risk of losing employment are nearly 3 million Russians who work either for companies based abroad or domestic companies in joint ventures with counterparts overseas.

For billionaire Oleg Deripaska, himself under U.S. sanctions since 2018, the plight is already dire enough to recall Russia’s 1998 default -- only “three times” worse.

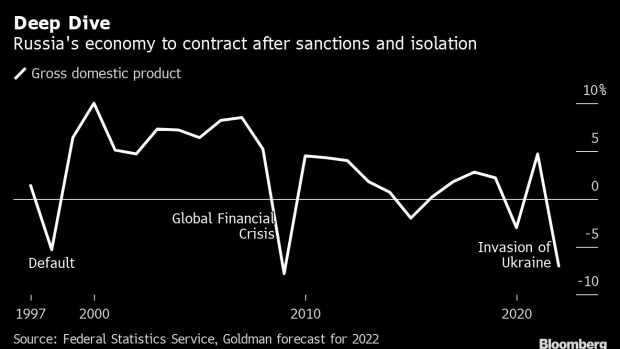

Gross domestic product contracted 5.3% in 1998 while unemployment exceeded 13% the following year. But Goldman Sachs Group Inc. and JPMorgan Chase & Co. see a 7% shrinkage of 2022. Bloomberg Economics forecasts a fall of about 9% and say it could be as much as 14% if curbs on energy exports are imposed.

“The crisis will last a minimum of three years and be extremely harsh,” Deripaska said on Thursday at a forum in the Siberian city of Krasnoyarsk. “An iron curtain has fallen.”

The grim truth is that although Russia wasted no time in seeking to contain the creeping financial meltdown with capital controls and other emergency measures that shuttered local markets, the devastation it inflicted upon its economy has no quick fix.

Ikea is pausing its local operations after a more than two-decade presence, a decision it expects will directly impact its 15,000 staff. Top carmaker Avtovaz, majority-owned by Renault SA and an employer of over 34,000, suspended assembly in two cities after running short of components.

Retailers are meanwhile stocking up on staples like buckwheat and salt. VTB Group, Russia’s second-biggest bank that’s among lenders under international sanctions, said it lured more than half a million new savers and near $9 billion in cash in just three days by offering deposit rates as high as 21%.

Despite soaring oil prices, the war in Ukraine came at a precarious moment for the Russian economy, long starved of investment and highly dependent on imports in industries as varied as textiles and cosmetics.

Over the past four years, the share of foreign goods in the non-food retail market barely budged and reached 75% in 2020, according to a report last November by the Higher School of Economics in Moscow. For car parts as well as toys and games, their proportion was over 90%, the study found.

Even after a government push to sanction-proof Russia since Putin’s annexation of Crimea in 2014, the sudden decoupling from the world economy is paralyzing production and threatening to stunt growth for years to come.

The ruble’s collapse of more than 30% so far this year will further ravage household finances while shortages and the uncertainty push up inflation.

“No bleak scenario will be an exaggeration,” said Sofya Donets, chief economist at Renaissance Capital in Moscow. “Inside the country, payment settlement and logistics haven’t been disrupted, but prices have gone up and inventories will be depleted in a month or two.”

Without government support, unemployment could exceed 10%, according to Donets, reaching a level last seen when Putin won his first presidential term more than two decades ago. The jobless rate was 4.4% in January.

What Bloomberg Economics Says...

“The early signs suggest that the current crisis is at least as serious for Russia as the great financial crisis of 2008-9 or the debt default of 1998. The economic fall out will be commensurately large -- with the price for Vladimir Putin’s war almost certain to be a deep recession.”

-- Scott Johnson and Tom Orlik

For the full report, click here

Besides trying to stabilize markets and arrest capital outflows, the government is crafting an anti-crisis program, with the first package of measures to help the economy adapt approved already this week. As part of an effort to pre-empt any shortages, health and industry ministers met with representatives of pharmaceuticals manufacturers and distributors to ensure supplies.

The central bank is though tightening the screws further having already doubled borrowing costs. In the latest move, individuals looking to buy hard currency in the open market will have to pay a 12% commission to brokers.

For all its reliance on foreign goods, Russia is more resilient after turning itself from one of the world’s major food importers to an exporter on a global scale. Restrictions enforced in response to the first round of sanctions eight years ago have also made its own food supply far less dependent on foreign produce.

Still, the nation may never be the same in the view of Deripaska, the founder of Hong Kong-listed aluminum giant United Co. Rusal International PJSC. and the target of U.S. sanctions.

Urging peace as the “first step” for an economy succumbing to crisis, he said Russia needs to pivot more decisively away from Europe and called for the country’s capital to be moved eastward to be nearer Asia.

“That’s our bullheaded focus on the West -- well, they don’t want us, we must forget them already,” he said.

©2022 Bloomberg L.P.