Nov 4, 2023

S&P 500’s Rebound Is at Risk From a Souring US Earnings Outlook

, Bloomberg News

(Bloomberg) -- The stock market just finished its best week in almost a year, but lurking beneath the euphoric surface are fears about Corporate America’s profit outlook.

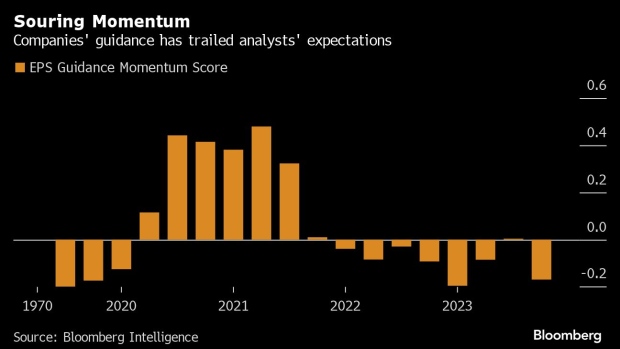

Among companies that have issued guidance this earnings season for next quarter and beyond, more have been providing estimates that trail analysts’ expectations. A gauge of forward guidance that compares corporate forecasts with the Wall Street consensus has been lower only once since 2019, data compiled by Bloomberg Intelligence show.

The equities optimists might look at that and conclude the C-Suite signals will end up being too conservative, setting the stage for eventual investor cheer. But the gloomier interpretation is that companies are quietly building caution as they grapple with a concerning global outlook and the demand headwinds from the Federal Reserve’s aggressive interest-rate hikes.

“If there’s a lot of optimism based on forward projections and suddenly that starts to turn, then it doesn’t bode well for stock prices,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors. “But we’re seeing more signs that cracks are beginning to form from tighter financial conditions and profit outlooks. Some analysts have been slower to come to terms with this.”

Only about a quarter of S&P 500 companies provide quarterly guidance, and just over half offer it on an annual basis, typically the technology and discretionary sectors. Earnings for most Big Tech companies have been in line or above expectations, though the outlook has dimmed along with broadly higher borrowing costs.

The S&P 500 gained 5.9% this week after weaker-than-forecast US jobs data on Friday bolstered bets the Fed is done tightening and caused Treasury yields to dive.

The gauge of earnings guidance momentum — derived in part from the ratio of increased versus reduced guidance — is hovering at the lowest level since the first quarter, and aside from that period is the lowest since 2019, Bloomberg Intelligence data show.

The downbeat signal suggests the profit expansion investors had been banking on may not be as swift as expected. The S&P 500 is on track to post earnings growth of 3.2% in the third quarter, halting a three-quarter streak of contracting profits, according to BI.

There are plenty of reasons for companies to be wary, ranging from a war in the Middle East to stubborn inflation to a lack of clarity on the economy. The Atlanta Fed’s GDPNow model sees fourth-quarter real GDP growth slowing to a 1.2% annual rate, from a 4.9% pace in the three months through September.

Sell-side analysts are taking notice. Since Oct. 6, they’ve cut their fourth-quarter EPS views by 1.9%, data compiled by Deutsche Bank AG show. This far into earnings season the view on the following reporting cycle has typically seen a 1% median drop, according to Deutsche Bank data going back to 2010.

Dim confidence in companies’ profit outlook is the main reason behind a lackluster reaction to third-quarter earnings, according to Justin Burgin, director of equity research at Ameriprise Financial.

The S&P 500 firms that missed analysts’ earnings estimates have trailed the benchmark’s performance by 3.8% on average a day after the results, the worst showing in a year, according to BI.

--With assistance from Alexandra Semenova.

©2023 Bloomberg L.P.