Apr 5, 2023

Saudi Quest to Become a Nuclear Player Is Coming Up Short

, Bloomberg News

(Bloomberg) -- Saudi Arabia’s efforts to break into the ranks of global uranium suppliers — and feed a nascent nuclear power program — are coming up short, with exploration investments failing to find any significant deposits of the heavy metal.

The amount worth developing is smaller than that found in Botswana, Tanzania or the US, according to an assessment published by the Nuclear Energy Agency and the International Atomic Energy Agency. This is the first time the Saudi government submitted data for the biennial Red Book, which is used by geologists prospecting for the commodity that fuels nuclear reactors.

Saudi Arabia has spent more than $37 million since 2017 searching for deposits but only managed to identify reserves that would be “severely uneconomic” to mine, the report said. The nation, which wants to develop a substantial mining industry by 2030, still has a “huge program in exploration for uranium” that could turn up richer veins in the future, Energy Minister Abdulaziz bin Salman said earlier this year.

Countries and companies are closely watching the kingdom’s efforts to develop a nuclear program. Saudi officials are assessing bids to build reactors, with companies from China, France, Russia, South Korea and the US in the mix.

It’s working closely with IAEA atomic regulators to implement the necessary laws to kick-start the program. The country built its first low-powered research reactor but can’t begin operations until safeguard rules are in place.

Saudi Arabia didn’t respond to requests for comment.

Chinese geologists helped the Saudis identify uranium deposits in the northwest, where the kingdom is planning the high-tech city of Neom. That vein, known as the Ghurayyah deposit, contains low concentrations of uranium embedded in hard granite rock and mixed with other metals, according to the report.

Uranium mining is at the start of the nuclear fuel cycle. The metal is processed into yellowcake, converted into a gas and then enriched to separate the uranium-235 isotope. That sustains the chain reaction necessary to produce energy.

Yellowcake prices have declined in recent decades because of plant shutdowns and public concern over nuclear power. Global expenditures on exploration of about $350 million are near 10-year lows, according to the Red Book.

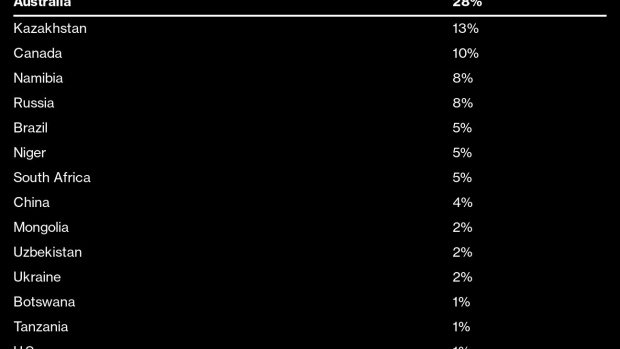

Rather than finding new deposits, the more immediate challenge for uranium markets could be solving the mismatch between nations that produce and consume the metal. The US, which has the biggest fleet of nuclear reactors, can only supply 1% of its demand.

Meanwhile, the largest miner, Kazakhstan, exports all production because it doesn’t operate any reactors.

©2023 Bloomberg L.P.