Nov 1, 2023

SBF Lied About ‘Big Things’ and ‘Little Things,’ Prosecutor Says

, Bloomberg News

(Bloomberg) -- Sam Bankman-Fried has been unfairly cast as a “villain” and a “monster” in a movie about a grand fraud scheme, his lawyer said Wednesday, insisting that the FTX co-founder made mistakes, but didn’t commit crimes.

In closing arguments in Bankman-Fried’s month-long fraud trial, the prosecution and defense presented their dueling views of the former crypto wunderkid. To the government, Bankman-Fried masterminded a “pyramid of deceit” built on lies and false promises that led to the costly collapse of FTX and its affiliated hedge fund Alameda Research.

In contrast, the defense painted Bankman-Fried as an awkward math nerd with bad fashion sense who in good faith tried to save his crumbling multibillion-dollar empire.

“We will agree there was a time when Sam was probably the worst-dressed CEO in the world and had the worst hair cut,” Cohen told jurors in the New York court.

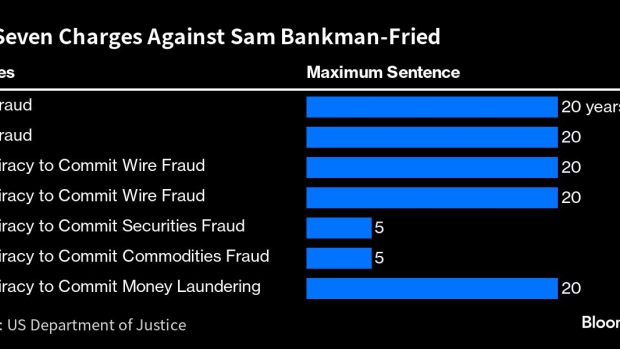

The jury could retire as soon as Thursday to begin deliberations in the case. The once-respected crypto mogul is facing decades in prison on charges that he directed the transfer of customer money at the FTX crypto exchange to Alameda for risky investments, political donations and expensive real estate before both companies collapsed into bankruptcy last year.

The 31-year-old is also accused of lying to investors about the unique relationship between FTX and Alameda that gave the latter unfettered access to customer funds.

Bankman-Fried, dressed in a gray suit and tie, shifted his gaze between the jury and his laptop as Cohen challenged the prosecution’s portrayal of him.

He took issue with evidence the government had presented during the trial about Bankman-Fried’s trademark unkempt hair, his sex life and awkward photographs of him with celebrities. The material had nothing to do with the heart of the case, particularly how the FTX exchange was run or the financial health of Alameda, Cohen added.

Cohen set out to defend Bankman-Fried against other key claims in the government’s case, including that he spent blindly on real estate in the Bahamas and venture investments. He said the MIT graduate saw the purchase of real estate — about $100 million worth — as a legitimate business expense to attract talent to the island where FTX was based.

He questioned why three former executives — all of whom have given damning testimony against Bankamn-Fried in the hope of receiving lighter sentences for their own criminal conduct — didn’t alert authorities earlier to the use of customer funds at Alameda if they thought it was wrong.

“Business decisions made in good faith are not grounds to convict,” Cohen said in his final statements to the jury.

Bankman-Fried’s parents, Joe and Barbara, have been at the trial almost every day but were absent for the prosecution’s closing argument. When Bankman-Fried walked into court in the morning, his father held his hand to his chest and smiled at him before leaving the courtroom. US Attorney Damian Williams, whose office led the investigation, was seated in the front row.

Earlier Wednesday, during the prosecution’s closing arguments, Assistant US Attorney Nicolas Roos told jurors that Bankman-Fried “lied about big things and he lied about little things” during his time on the witness stand.

“He came up with a tale that was conveniently put together to exclude himself from the fraud” at FTX, Roos told jurors during his animated address. “Over three days he took the stand and he lied.”

Roos contrasted Bankman-Fried’s “perfect memory” under questioning by his own lawyer with his inability to remember even simple details once cross-examination began. He accused the former executive of lying about when he knew Alameda owed $10 billion to FTX and saying he couldn’t recall more than 140 times.

The prosecutor attempted to simplify the case for jurors, urging them not to be distracted by technical jargon like coding, auto-liquidation engine and margin trading.

“It’s about perception, it’s about lies, it’s about stealing, it’s about greed,” Roos said.

(Updates with additional arguments starting in 10th paragraph)

©2023 Bloomberg L.P.