Jul 6, 2022

Shanghai’s New Round of Covid Testing a Worry for the Oil Market

, Bloomberg News

(Bloomberg) -- A new program of virus testing in Shanghai will be a worry for the oil market.

China’s consumption of gasoline and diesel is nearing a return to pre-Covid levels as the nation cautiously emerges from the latest round of stringent controls, including a punishing two-month shutdown of the financial center. The fuels account for about half of China’s oil usage.

That rebound in demand has exceeded expectations at Goldman Sachs Group Inc. Although crude remains in the grip of global recession fears, China’s loosened virus restrictions and economic stimulus are “creating upside risk” for prices in the second-half of the year, according to a note from the bank.

The mass testing in Shanghai takes place through Thursday following an uptick in cases and will cover more than half the city. It wouldn’t be a surprise for that kind of trawl to uncover fresh infections, at which point the focus becomes whether the government will stick to an interpretation of Covid Zero that has proven so economically bruising.

Two further cases have been found outside quarantine, according to a briefing by city officials on Wednesday.

Events Today

(All times Beijing unless shown otherwise.)

- State Council briefing on environmental inspections in Beijing, 10:00

- CCTD’s weekly online briefing on the coal market, 15:00

- NDRC seminar in Beijing on hog output and prices, 15:00

- Tianqi Lithium to price its Hong Kong listing

Today’s Chart

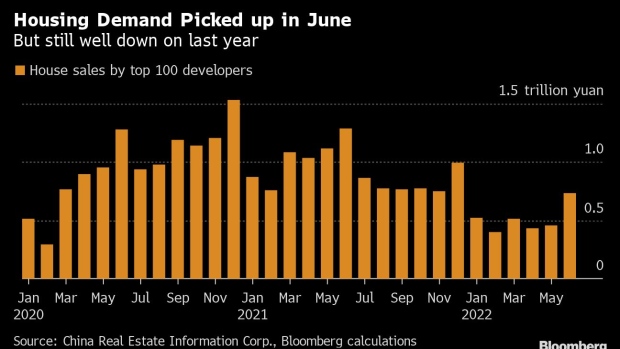

China’s real estate slump is probably past its worst -- but the market remains a long way from a full recovery. The industry, which accounts for about a third of Chinese steel demand, is expected to remain depressed due to a weak job market, a prolonged cash crunch and low confidence on house prices.

On The Wire

China’s hog futures and pig breeding stocks tumbled as intensive government efforts to curb prices hit sentiment.

- Iron Ore Gives Up Gains Amid Covid Flareups, More Output Cuts

- China Dairy Producers Stay Resilient Against Higher Input Costs

- China to Speed Up Investment of Special Bond Proceeds: Newspaper

- China Swaps Out US Soybeans as Demand Flips to South America

The Week Ahead

Thursday, July 7

- China’s foreign reserves for June, including gold

- Antaike’s Nonferrous Metals Market Report Conference in Beijing

- Chongqing gas exchange hosts industry summit, day 1

- USDA weekly crop export sales, 08:30 EST

Friday, July 8

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- Fenwei Coal’s weekly online market briefing, 15:30

- China-Europe Floating Offshore Wind Cooperation Forum in Hainan

- Chongqing gas exchange hosts industry summit, day 2

Saturday, July 9

- China to release April aggregate financing & money supply by July 15

- China’s inflation data for June, 09:30

- Caixin Summer Summit in Beijing, day 1

Sunday, July 10

- Caixin Summer Summit in Beijing, day 2

©2022 Bloomberg L.P.