Nov 19, 2020

Shopify, Barrick join exclusive Canadian club with big cash hoards

, Bloomberg News

Ottawa knows aid programs are full of holes, but won't tax Canadians now: CIBC's Tal

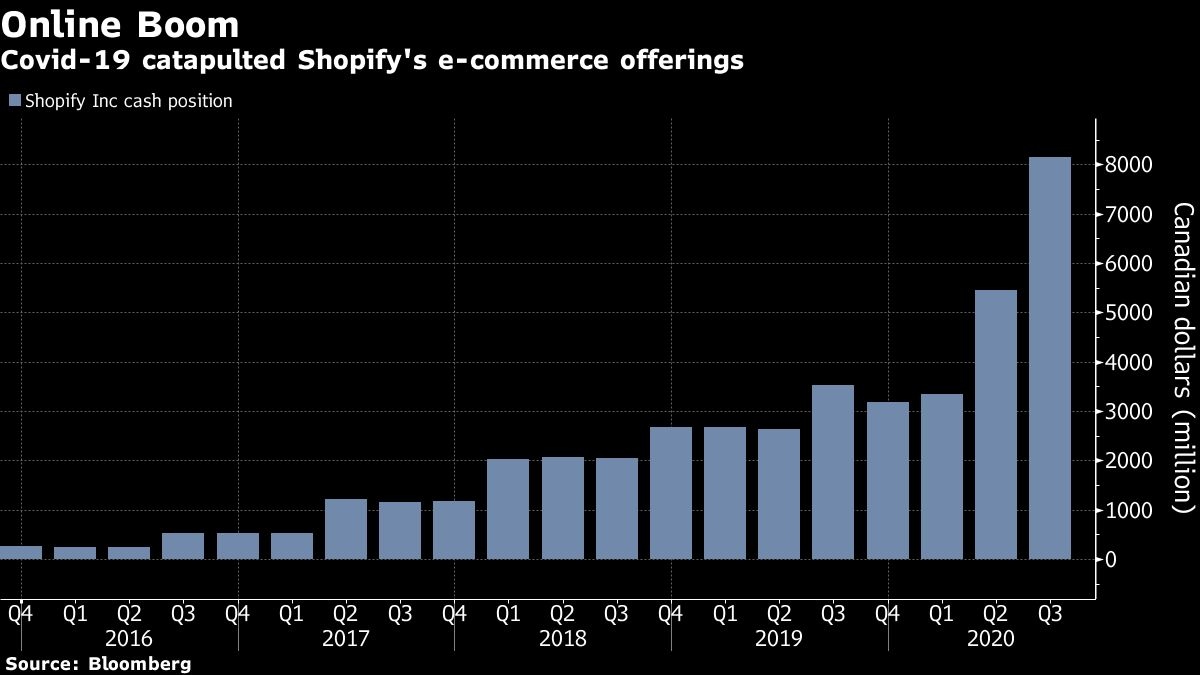

The COVID-19 pandemic has made for a rare moment in Corporate Canada: three companies entered this quarter with over $5 billion of cash.

Shopify Inc. and Barrick Gold Corp. joined Air Canada in reporting a hefty pile of cash and short-term investments at the end of the quarter. It’s the first time that many non-financial companies on the S&P/TSX Composite Index have been so flush in the last 25 years, according to data compiled by Bloomberg.

The three companies have seen their war chests balloon for different reasons. Barrick and Shopify are prospering, while Air Canada has gone on a mammoth capital-raising spree to secure the funds to survive the COVID-19 pandemic.

Barrick, the world’s second-largest gold producer, has seen its cash position swell amid surging gold prices as investors flocked to haven assets earlier this year. It spun out US$1.3 billion of free cash flow in the third quarter allowing it to boost its dividend for the third time in the past year. Barrick held about $6.1 billion of cash as of the end of the third quarter.

For tech darling Shopify, revenues have skyrocketed but it also raised US$1.3 billion via a share sale earlier this year as its stock surged. The Ottawa-based e-commerce firm ended its third quarter with over $8 billion in cash as COVID-19 accelerated adoption of its online selling software and other services. Chief Executive Officer Tobi Lutke told analysts on its third-quarter earnings call that he’s “not a huge fan of M&A for acquiring revenue.”

Air Canada, which lost much of its value likes other pandemic-hit airlines, has so far managed to avert bankruptcy by raising new equity and debt, expanding its cargo services, reducing flight capacity and cutting tens of thousands of jobs. It expects to burn between $1.1 billion and $1.3 billion of its cash in the fourth quarter amid COVID-related travel restrictions. The Canadian airline has about $7.8 billion in cash and equivalents.

While this is a notable moment for publicly-listed Canadian companies, the U.S. boasts a much larger pool of cash-rich firms: over 100 non-financial S&P 500 companies have the equivalent of $5 billion and nearly one in seven boast twice as much.