Nov 25, 2019

Siemens Considers Buying Iberdrola’s Siemens Gamesa Stake

, Bloomberg News

(Bloomberg) -- Siemens AG is considering buying Iberdrola SA’s 8% stake in wind-turbine maker Siemens Gamesa Renewable Energy SA to bolster its energy holdings, according to people familiar with the matter.

Siemens could pay a premium to the current value of about 720 million-euros ($793 million), bringing its holding to about 67%, said two of the people, who asked not to be identified because the matter is private. An eventual move to acquire the rest of the outstanding shares in Siemens Gamesa is possible at a later date, the people said. No decision has been made and there’s no certainty the deliberations could lead to a transaction, they said.

Siemens Gamesa shares rose as much as 9.1%, while Siemens was trading 1.1% higher and Iberdrola stock rose 0.2%.

Representatives of Siemens and Iberdrola declined to comment. A spokeswoman for Siemens Gamesa said she could not provide immediate comment.

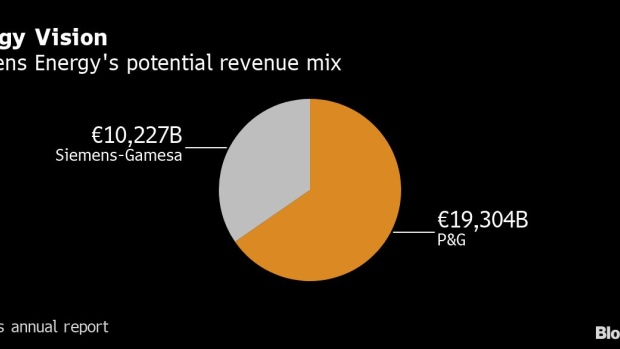

A move by Siemens to strengthen its hold over its energy businesses would come in preparation of a planned spin off next year of its struggling power and gas unit -- dubbed Siemens Energy -- which will hold a 59% stake in Siemens Gamesa. The acquisition of all of Siemens Gamesa would remove one layer of complexity in the operation and the structure of the future spinoff.

Siemens’s Chief Executive Officer Joe Kaeser said in an interview earlier this month that he aims to shed about 75% of the energy division over time. The power and gas unit is Siemens largest by revenue but has the lowest profit margin. It has struggled for years with a slump in global orders for thermal power plants.

Read more: Siemens CEO Seeks to Shake Up Company With Energy Spinoff (1)

Kaeser has spun off a series of activities in recent years including renewable energy and health care. In 2016, Siemens and former rival Gamesa Corp Technologica SA struck a deal that saw the German company injecting its wind turbine operations into the Spanish counterpart in exchange for a stake. The Spanish securities regulator at the time exempted Siemens from making a mandatory offer to Gamesa’s other shareholders.

The tie-up hasn’t always been smooth, with synergies falling short of what has been needed to offset lower turbine prices, increased competition and a dip in demand. Frictions were laid bare late 2017, when Iberdrola’s Chairman Ignacio Galan said “we can’t be happy with a company whose value has declined by more than 50% in six months.”

(Updates with share prices in third paragraph.)

--With assistance from Rodrigo Orihuela and Charles Penty.

To contact the reporters on this story: Eyk Henning in Frankfurt at ehenning1@bloomberg.net;Oliver Sachgau in Munich at osachgau@bloomberg.net

To contact the editors responsible for this story: Kenneth Wong at kwong11@bloomberg.net, Tara Patel, Ben Scent

©2019 Bloomberg L.P.