Jul 21, 2022

Snap's drop cools stock optimism before Asia open

, Bloomberg News

Avoid commodities and own defensive healthcare stocks: Chad Morganlander

Asia’s stock markets face a cautious start Friday after a dash of disappointment over technology earnings injected fresh worries about the economic outlook and took some sheen off a US equity rally.

Futures rose modestly for Japan and Australia in the wake of the best three-day gain for the S&P 500 index since late May. Hong Kong contracts were higher following an advance in US-traded Chinese shares.

But US social-media firm Snap Inc. slid in extended trading on poor results that flagged worries about an advertising slowdown, weighing on the likes of Facebook parent Meta Platforms Inc. and Google’s Alphabet Inc. Contracts on the S&P 500 and tech-heavy Nasdaq 100 retreated.

Treasuries surged Thursday, pushing the 10-year yield below 3 per cent. Rising US jobless claims, a dimming regional factory outlook and a weaker leading economic indicator stoked recession risk amid tightening monetary policy.

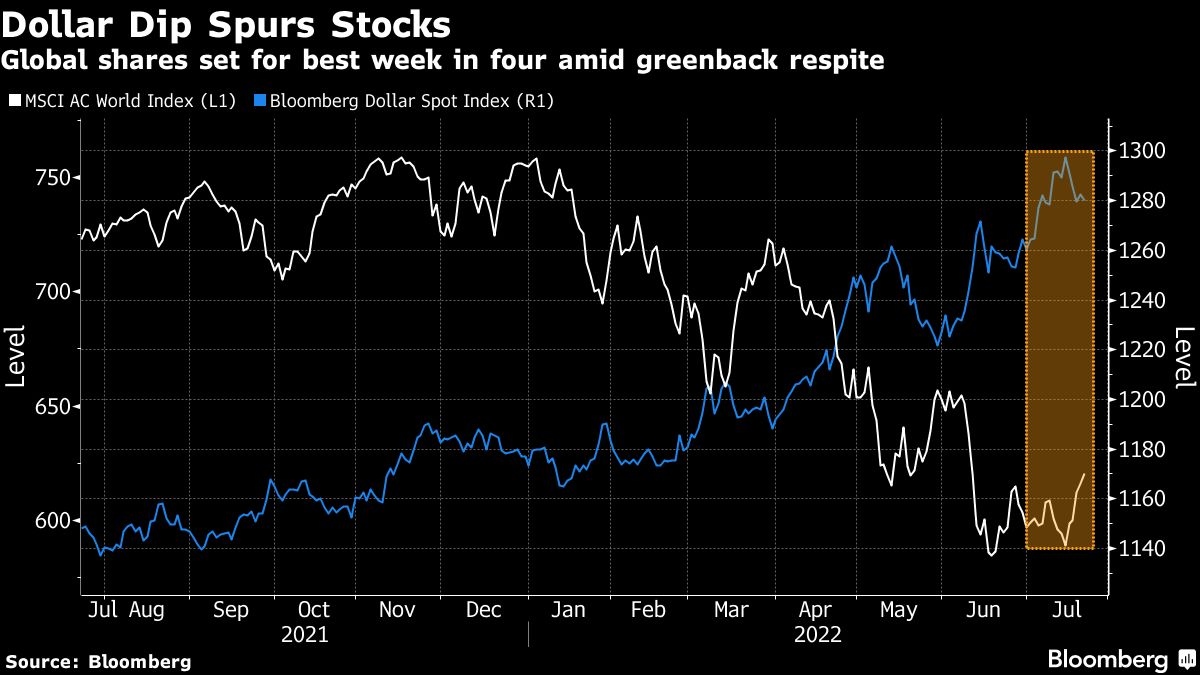

A dip in the dollar in recent days that suggested less fear in markets has helped to put global stocks on course for their best week in a month, paring this year’s equity market rout to about 18 per cent.

But angst about the looming damage from high inflation and rapidly rising interest rates is proving hard to shake despite a tempering in expectations of just how aggressive the Federal Reserve will be.

“I would point out that we have a lot of earnings to come next week, we have the Fed meeting next week,” Susquehanna International Group derivatives strategist Chris Murphy said on Bloomberg Television. “I don’t necessarily think we’re totally out of the woods yet.”

Elsewhere, the euro remained higher after the European Central Bank’s 50 basis-point interest-rate hike, the first increase in 11 years.

The monetary authority is tackling elevated price pressures but faces a slew risks. Concerns linger that Russia could choke European gas supplies in the fallout from President Vladimir Putin’s war in Ukraine. In Italy, a political crisis poses an added complication for the region.

Commodities remain under pressure, in part as China grapples with COVID cases and growth-sapping mobility curbs. Crude traded around US$96 a barrel.

Traders were also monitoring President Joe Biden’s condition after he tested positive for COVID and showed mild symptoms.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.5 per cent as of 7:09 a.m. in Tokyo. The S&P 500 rose 1 per cent.

- Nasdaq 100 futures fell 0.8 per cent. The Nasdaq 100 rose 1.4 per cent

- Nikkei 225 futures rose 0.4 per cent

- Australia’s S&P/ASX 200 Index futures rose 0.2 per cent

- Hang Seng Index futures rose 0.7 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro was at US$1.0225

- The Japanese yen was at 137.46 per dollar

- The offshore yuan was at 6.7692 per dollar

Bonds

- The yield on 10-year Treasuries declined 15 basis points to 2.87 per cent

Commodities

- West Texas Intermediate crude was at US$96.49 a barrel

- Gold was at US$1,717.87 an ounce