Mar 21, 2019

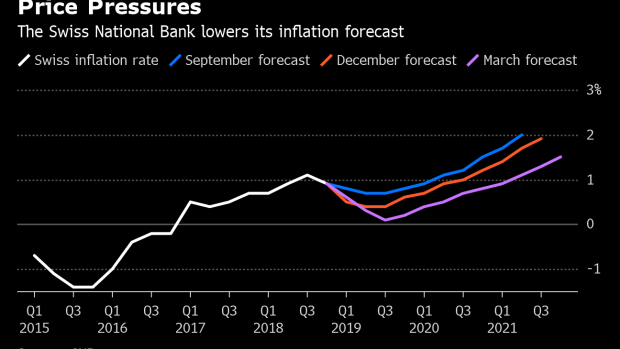

SNB Keeps Rock-Bottom Interest Rates, Cuts Inflation Forecast

, Bloomberg News

(Bloomberg) -- The Swiss National Bank responded to the worldwide economic slowdown by keeping interest rates at rock bottom and cutting its inflation forecast.

Citing risks from political uncertainty such as Brexit and protectionism, the SNB kept its deposit rate at minus 0.75 percent on Thursday, as expected by economists in a Bloomberg survey. It also reiterated its pledge to intervene in currency markets, once again labeling the franc as “highly valued.”

Central banks around the world are rethinking their next policy steps amid threats to the global expansion. On Wednesday, Federal Reserve Chairman Jerome Powell made yet another dovish shift with a prediction that U.S. interest rates could be on hold for “some time.”

The SNB, led by Thomas Jordan, has long been seen in no rush to start tightening, and that position was probably reinforced after the European Central Bank committed this month to keeping interest rates low for longer.

Switzerland’s low rates are primarily designed to keep a differential with the euro area and stem appreciation pressure on the haven franc. The currency was at 1.13153 per euro as of 09:35 a.m. Zurich time.

For the past two months, it’s mostly traded within a range of 1.13-1.14, though increased investor anxiety about a cliff-edge Brexit or other political tensions could boost it, putting downward pressure on inflation. The SNB spent about 2.3 billion francs intervening in currency markets in 2018, a fraction of the 48 billion francs spent the previous year.

The SNB forecasts that consumer-price growth will average just 0.3 percent percent this year and 0.6 percent in 2020, according to their updated assessment. That’s lower than the 0.5 percent and 1 percent previously predicted. It kept its 2019 growth prediction at around 1.5 percent.

--With assistance from Jan Dahinten, Zoe Schneeweiss, Brian Swint, Patrick Winters, Dale Crofts and Harumi Ichikura.

To contact the reporter on this story: Catherine Bosley in Zurich at cbosley1@bloomberg.net

To contact the editors responsible for this story: Fergal O'Brien at fobrien@bloomberg.net, Jana Randow

©2019 Bloomberg L.P.