Jun 18, 2021

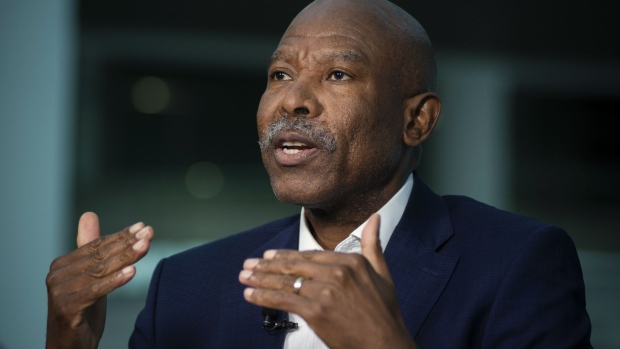

South Africa Ready for Global Policy Tightening, Kganyago Says

, Bloomberg News

(Bloomberg) -- South Africa’s central-bank governor said the country is in a strong position to deal with global monetary policy tightening and the gradual pullback by policy makers from the stimulus measures enacted amid the Covid-19 pandemic.

When developed countries start to normalize interest rates, Africa’s most industrialized nation will be “going into normalization from a very solid basis,” Lesetja Kganyago told an investment conference on Thursday.

“The economy is less vulnerable than it was last year –- we have got a current-account surplus and the budget balance has recovered faster than we had actually expected,” he said. “That should help the Treasury stabilize debt.”

South Africa posted its first current-account surplus in almost two decades in 2020 as import demand was suppressed by the economy’s contraction and the value of gold exports rose due to higher prices for the commodity. The central bank forecasts the current-account surplus to average around 1.3% of gross domestic product this year, Kganyago said.

And the country’s main budget deficit for the 2020-21 fiscal year is smaller than the government’s previous projection after spending undershot estimates while revenue surprised on the upside.The nation recorded a shortfall of 551.9 billion rand ($39 billion), or 11.2% of gross domestic product, on its main budget for the year through March 2021 compared with the estimate of 12.3% that Finance Minister Tito Mboweni presented on Feb. 24.

The improvement in the current-account and budget balances places the country in a better position to deal with the repricing of financial assets globally and a realignment of exchange rates that will be brought about by the normalization, Kganyago said.

Should the realignment of exchange rates feed through into domestic inflation, the central bank will be ready to act, he said.

©2021 Bloomberg L.P.