Sep 15, 2023

‘Stakes Are High’ as China Has Tools to Strike Back at EV Curbs

, Bloomberg News

(Bloomberg) -- The European Union launched an investigation into Chinese subsidies for electric vehicles this week, highlighting the growing industrial and geopolitical competition between the two economies.

The probe may ultimately lead to import tariffs on Chinese vehicles, drawing sharp rebuke from Beijing, who called the move a blatant act of protectionism. There are also concerns that Beijing may retaliate against any trade curbs.

Here are the ways China could hit back at the possible tariffs:

Restrict Trade and Market Access

The most powerful tool Beijing can wield is restricting access to its huge domestic market. China is the world’s largest car market, and while foreign car manufacturers are losing market share, German car companies are still very reliant on revenue from China. German brands sold 4.6 million cars in the Asian country last year and other European Union members sold about 283,000 units.

Beijing could impose retaliatory tariffs on imports from Europe, but the impact wouldn’t go far. Most of these vehicles are made in China and such a move could expose China to World Trade Organization action. The EU could also use its new anti-economic coercion tool, which allows possible countermeasures such as tariffs and restrictions on access to foreign direct investment.

Should Chinese consumers decide to boycott European car companies — just as they did in the past with Japanese and Korean cars when there were geopolitical disputes — sales would take a hit. A consumer boycott has the advantage of being harder to prove that it’s the result of government action.

Beijing could also retaliate against other European product exports. Duncan Wrigley, chief China economist at Pantheon Macroeconomics, said China is likely to target luxury goods, cosmetics and wine.

In the case of Australia, China imposed curbs on a range of goods including barley, wine, lobster, beef, timber and coal when its relations with Canberra took a nosedive in 2020. Those restrictions are only now being gradually lifted.

In 2013, a day after the EU imposed tariffs on imports of solar panels from China, Beijing launched anti-dumping and anti-subsidy probes into wine imports from the EU and threatened another probe against luxury cars. Those actions were eventually dropped after the two sides resolved the dispute.

After news of the latest EV probe, Beijing said Thursday it will maintain anti-subsidy duties on potato starch imported from the EU for five years.

What Bloomberg Economics Says ...

“In China’s manufacturing, EVs are still relative small fry. But the industry’s rapid expansion, innovation and advanced manufacturing techniques hold promise for future economic growth. It’s also supporting other sectors — when the economy is short on growth drivers. EU tariffs on Chinese EVs would hurt.”

— Eric Zhu and David Qu, economists

Read the full report here.

Restrict Exports

China is the EU’s biggest trading partner and the 27-nation European bloc is reliant on China for supplies of various critical minerals.

One way Beijing could retaliate against any EU action would be to limit access to rare earths, which go into the making of not only batteries but other electronic components, said Ja Ian Chong, an associate professor of political science at the National University of Singapore, who has written on Chinese economic coercion.

China temporarily restricted exports of rare earths to Japan in 2010 during a dispute, but hasn’t used that tool recently. In July, Beijing started to license exporters of two metals — gallium and germanium — that are used in making chips, EVs and telecommunications equipment, prompting concern it could start cutting back on shipments.

If the tariffs levied by the EU are too high, “China will certainly take measures on rare earth supply,” said Zhao Yongsheng, a professor at the University of International Business and Economics in Beijing. “It’s highly unlikely that China would just watch and let it go.”

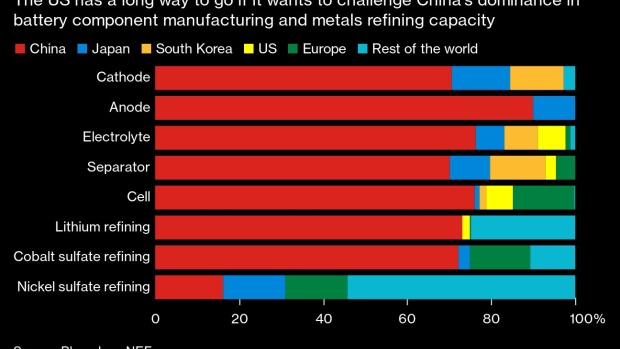

China has a dominant position in the production of batteries and critical minerals such as lithium and rare earths. EU demand for lithium could surge up to 18 times by 2030, and 60 times by 2050, according to a 2022 report from the European parliament. The EU mines only a small fraction of the lithium it consumes, and relies on China to process it.

Read more: Hungary Sees €3 Billion in New Chinese Car Industry Investment

However, Chinese firms such as battery maker Contemporary Amperex Technology Co. are rapidly ramping up investment in Europe, so any restrictions on exports to Europe of battery-related materials could damage Chinese firms just as much as European companies.

Tourism Ban

Another retaliatory tool China has used in the past is to restrict tourism to inflict economic punishment. When Beijing had a dispute with Seoul over the deployment of a US missile defense system known as Thaad, there was a tacit ban on Chinese tour groups going to South Korea. Tour groups are still banned from visiting Taiwan.

Before the pandemic, millions of Chinese tourists visited Europe each year, but the slow recovery since China reopened its borders earlier this year means it’s not as potent a tool as it might otherwise be.

‘Breathing Space’

The EU probe is likely to take about nine months, and China probably won’t act before Europe does.

The investigation reflects a desire to ease the rate of transition to EVs, especially for economies that have built a reputation and ecosystem for traditional vehicles — particularly Germany, said Deborah Elms, executive director at Asian Trade Centre in Singapore.

“That either postpones the inevitable a little longer or gives firms breathing space to retool themselves for this new competition,” Elms said. “The stakes are high for everyone. This is going to be a very contentious period.”

--With assistance from Jinshan Hong and Shirley Zhao.

©2023 Bloomberg L.P.