Apr 4, 2022

Star Royalties takes gold one step closer to a carbon-negative future

- The global ESG investment market could hit U.S. $53 trillion within the next three years

- Star Royalties finances gold mines but is increasing its involvement in green projects such as carbon sequestration and regenerative agriculture

- The company has also started Green Star Royalties to accelerate its involvement and investment in the fight against climate change

- Green Star’s recent relationship with Agnico Eagle Mines, a senior Canadian gold mining company, will help to accelerate the pace and scale of participation in carbon credit opportunities

The average person’s familiarity with borrowing and investing is often limited to credit cards, mortgages, and retirement savings plans. But at the corporate level, borrowing is done on grand scales using complex instruments, from multi-institution loans to sales of stock.

Another form of financing that is popular, especially among mining companies is royalties. In the case of mining minerals or precious metals such as gold, a royalty company helps fund mining in exchange for royalties on — i.e., a percentage of — whatever a project produces; alternately, the royalty company may receive rights to a stream or a designated quantity of whatever the mine produces.

With that promise of return, however, comes risk, and assessing environmental, technical and geopolitical risks is crucial for a royalty company and its investors.

Star Royalties Ltd. (TSXV: STRR, OTCQX: STRFF), which launched in 2019 and went public in February 2021, is familiar with the risks and rewards of gold royalties but is increasingly offsetting those risks while contributing to the fight against climate change.

Capturing the value of green investment opportunities

“When we started our business, we always had a mandate to invest in green opportunities from day one.” Alex Pernin, CEO, Star Royalties Ltd.

As part of its portfolio construction strategy, the company began allocating 80 per cent of its capital to precious metals and 20 per cent to green deals: carbon offset credit projects (biosequestration and renewable energies) and green technology opportunities (diesel usage displacement).

In addition to paying strict attention to its investments, valuing quality over quantity, and managing risk by only working with companies in the best jurisdictions, the company's management team also looks for green business opportunities.

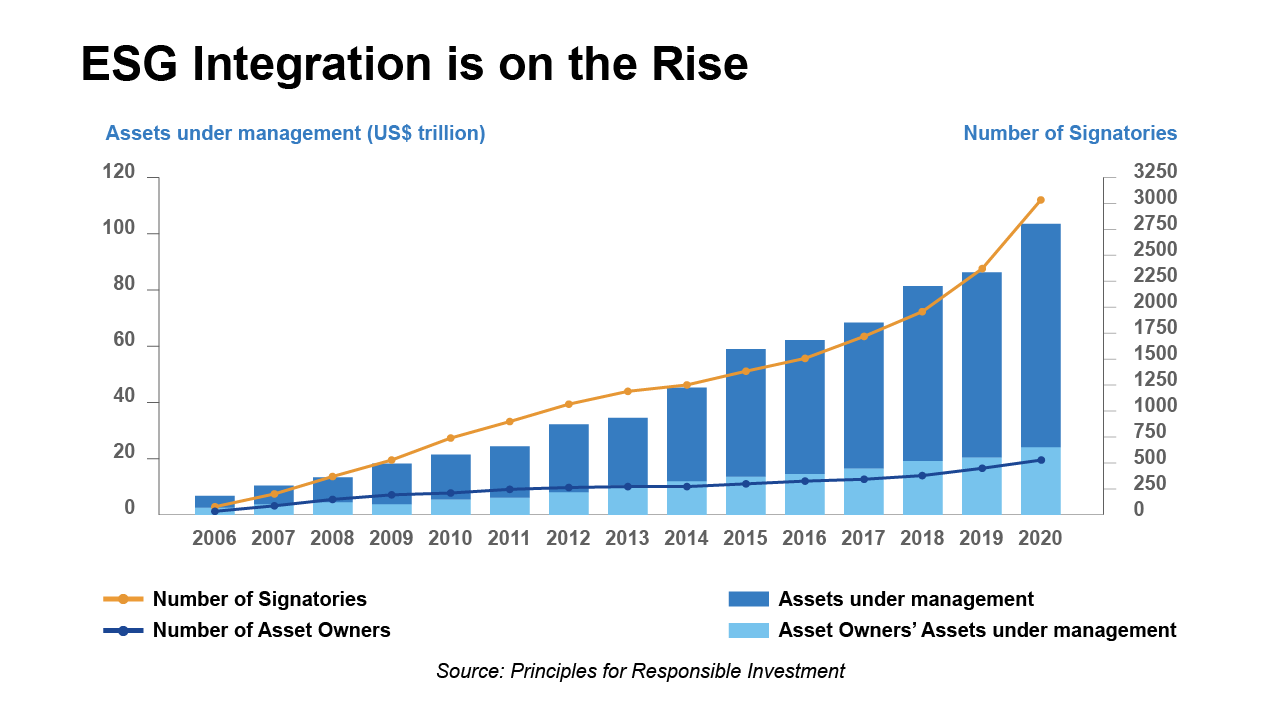

Two years ago, roughly halfway between Star’s launch and its IPO, the company started the first-ever carbon credit royalty, which prompted an overwhelmingly positive reaction, Pernin says, noting companies and investors are, more than ever, looking for opportunities that tick ESG (environmental, social and governance) boxes. “Anything for the green revolution, to decarbonize the environment,” he notes.

Indeed, Star Royalties views ESG-related investments as a highly scalable business model with attractive returns.

Its Subsidiary, Green Star, accelerates the growth of Star Royalties’ pure-green portfolio

How bullish is Pernin and the company on green investment opportunities?

In October 2021, they started Green Star Royalties, a separate corporate entity aimed at accelerating the growth of the company’s pure-green portfolio beyond its 80/20 allocation framework.

Green Star positions the company to be carbon negative by 2023, through its existing and future carbon offset projects, whose sequestration benefits more than offset both the company’s direct CO2 emissions and CO2 emissions from its gold equivalent ounces.

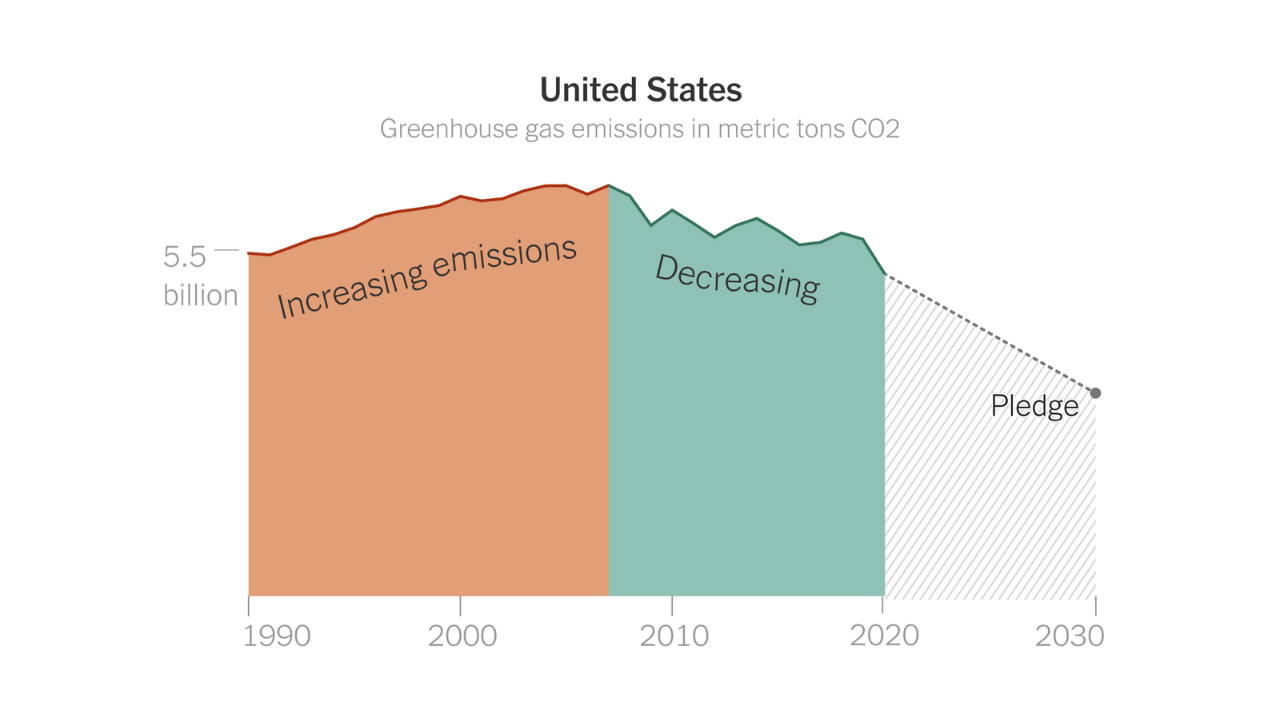

Green Star Royalties’ goal is to provide shareholders with exposure to an anticipated dramatic rise in carbon credit pricing required to reach global greenhouse gas emission reduction targets by 2030, as outlined in the Paris Agreement, an international treaty on climate change.

The company currently has about U.S. $32 million invested in eight royalties and one stream, and its relationship with Agnico Eagle Mines, a senior Canadian gold mining company, is expected to accelerate the pace and scale of participation in and origination of carbon credit opportunities.

Just recently, Star announced a private placement with Agnico Eagle to become a 35 per cent strategic shareholder of the Green Star Royalties. This significant funding into the company is expected to accelerate its ability to pursue larger green opportunities and to establish a substantial pure-green royalty company that should attract capital from both generalist and ESG-focused investors. Among the growing number of carbon credit royalties, this marks the strongest relationship with a large corporate entity to date.

“We’re funding projects to sequester carbon. We’re not buying existing carbon credits or committing to being carbon neutral 30 years from now,” says Pernin. “We’re investing in projects today that sequester carbon today.”

“And therefore, we’re getting a lot of interest from large institutional investors and large corporates because they want to get involved and do what we do. We have the skillset now where we can finance projects into existence.”

Carbon sequestration and regenerative agriculture investments could be the next move

Among such projects, Star has gross revenue royalty agreements with Elizabeth Métis Settlement (EMS), a community on the Alberta/Saskatchewan border, with Green Star now owning an effective 40.5 per cent gross revenue royalty on the EMS Forest Project, a carbon sequestration project.

As well, Star has partnered with Blue Source LLC, North America’s largest and most reputable carbon offset developer and marketer, with which it worked on the EMS project, to finance the creation of premium, verified carbon offset credits that will reward the adoption of regenerative agriculture practices by North American farmers. Regenerative farming focuses on soil health and organic matter to increase carbon sequestration and resilience to climate change.

All these projects provide not only environmental benefits, but benefits to investors, Pernin says. He notes that the price for carbon credits in Canada, where large emitters are mandated to pay a carbon tax or purchase carbon credits, has doubled in recent years. “So, we’re investing in a commodity that’s going to more than quadruple in less than 10 years from now” — an escalation, he notes, investors may not see in most commodities.

The environmental benefits are core to Star Royalties’ and Green Star Royalties’ missions. “This is the business model,” he says. “We’re doing good and we’re doing well — we’re doing good for the environment and we’re doing well financially.”

“The better the environmental project that we’re financing, the better it is economically. They’re completely correlated.”

The buzz around ESG investments grows rapidly

Others agree. An article on the website of Ernst & Young Global Ltd., an international professional services company, states, “Our approach to ESG needs to evolve, and fast, if it is to realize its full potential. Investors and other stakeholders want better environmental, social and governance disclosures to help them understand more about how a company performs, makes decisions and creates value. They want to understand the external impact of a company’s actions, both in absolute terms and in comparison to other companies.”

Indeed, ESG fund assets are booming. In Canada alone, there were more than 144 ESG funds available in 2021, which was a 40 per cent increase from the previous year, when U.S. $334 million went into those funds. And globally, ESG assets may hit U.S. $53 trillion by 2025.

Pernin says Star Royalties, and its subsidiary Green Star, which may one day be a publicly traded company of its own, are well poised to take advantage of evolving expectations of investors regarding return and environmental impact.

The pathway to growth for Green Star picks up as others begin to recognize its potential value. The establishment of a long-term relationship with Agnico Eagle, a company that is aligned with their commitments to a sustainable future, represents a strong endorsement of the company’s green royalty business model.

As well, he says Star, which is led by an experienced team of industry experts whose resumes include time with large miners (Barrick), portfolio managers (Sentry Select), brokerages (Canaccord Genuity) and royalty companies (Franco Nevada), is expecting its gold equivalent sales to have an estimated 80 per cent in compound annual growth rate by 2025, with a focus on new royalty opportunities and continued partnerships with Indigenous communities.

Pernin is also bullish given that he heads the world’s first carbon-negative gold royalty platform that’s also an innovator in carbon credit royalties.

“The environmentalist in me and the capitalist in me are merging here,” he says. “It’s nice to see money coming in to support the environment.”

For more information on Star Royalties Ltd., visit its website here.

Make sure to follow Star Royalties on social media for the latest news: