Dec 16, 2022

Steel prices to rebound in first half of 2023, Stelco CEO says

, Bloomberg News

Paul Harris discusses Stelco Holdings

A flurry of steel buying in the past few weeks has stoked optimism from Stelco Holdings Inc.’s top boss about the next six months.

The Canadian steelmaker has fully booked shipments to the end of the year and has made “meaningful inroads” into the first half of next year, according to Chief Executive Officer Alan Kestenbaum.

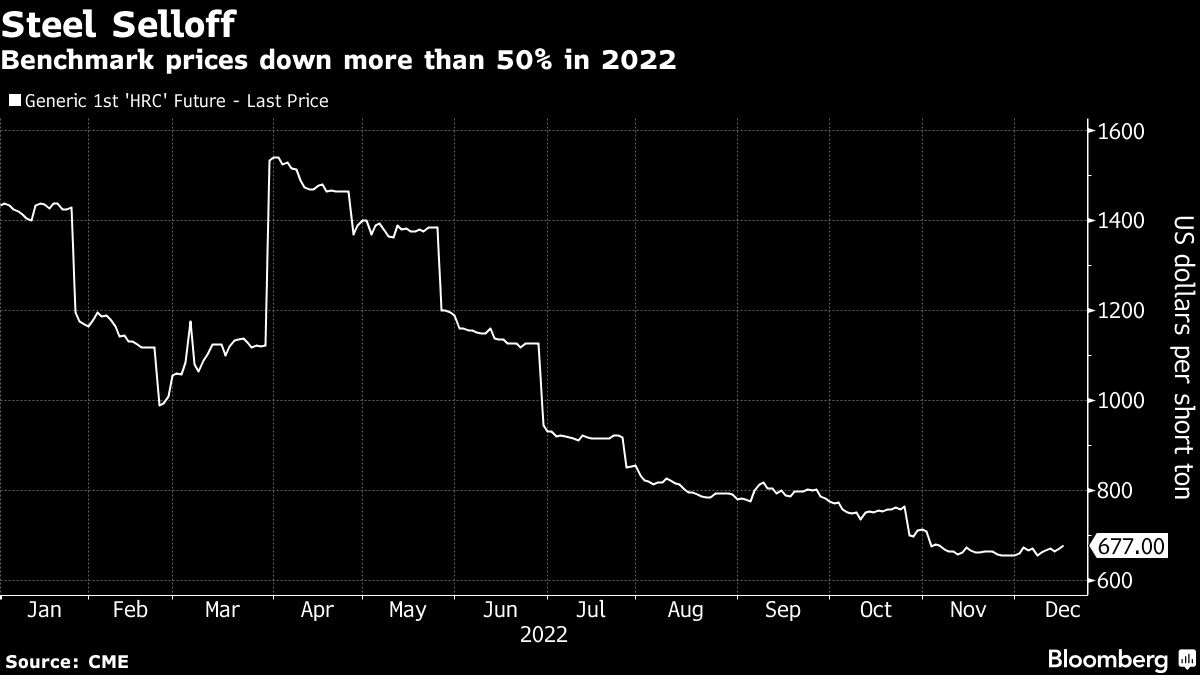

The turnabout comes after months of declines in steel prices as demand fell, making it difficult for producers to sell the metal that’s key to automaking and construction. Steel prices have fallen more than 50 per cent this year, including an almost 15 per cent decline in the last three months alone that had weighed on the business of Hamilton, Ontario-based Stelco.

“What we saw maybe three weeks ago was weakness in pricing and demand, even just filing up the fourth quarter was difficult,” Kestenbaum said in a phone interview. “Prices have turned and people don’t want to miss the bottom, so they’re trying to replenish inventories.”

His comments come a day after three of the biggest American steelmakers sent mixed signals to the market, with Nucor Corp. warning of a potential recession and US Steel Corp. noting that demand in December improved as customer inquiries accelerated.

Kestenbaum, who isn’t one to shy away from commenting on the steel market, said he thinks a recession is unlikely, largely because unemployment remains stubbornly low. Still, steel demand in the second half of 2023 depends entirely on which way the broader economy goes.

Kestenbaum in August called a bottom in the steel market, at the time saying order book activity had picked up after a summer lull. When asked this week what he got wrong, the CEO said he didn’t realize the degree to which buyers were willing to let their inventories run down. It’s only now that Stelco and others have seen buyers begin to build back stockpiles.

As for specific key industries the steel market sells into, Kestenbaum said he sees little change in demand from the auto sector next year since higher interest rates are making it difficult for many consumers to afford new car loans. Non-residential construction will also face problems from higher rates, he said, but short of a recession he doesn’t see the sector declining much.

Steel prices will see an uptick in the early part of next year before doing “a bit of coasting,” according to the CEO.

“I don’t think we’ll have an explosive year — I’m not expecting that in 2023,” he said. “I think we’ll have a mediocre year compared to the last two years.”