Jun 6, 2023

Stock Fears Tied to US Debt Wave Miss the Mark, Deutsche Bank Says

, Bloomberg News

(Bloomberg) -- Deutsche Bank is throwing cold water on the prevailing market narrative that the replenishment of the US government’s coffers by a flood of new bill sales will hurt equities.

Over the last three years, investors have increasingly pointed to the booming liquidity provided by the Federal Reserve as the driving force behind the rally in stocks, but according to the bank’s strategists Parag Thatte and Steven Zeng, most of the gains can be attributed to fundamentals such as earnings or macroeconomic growth indicators. And the recent strong correlation between Fed stimulus and equity returns is historically inconsistent, making the argument even more questionable.

“The whole idea that there’s liquidity holding the market up just doesn’t add up,” Thatte said in a phone interview.

Officials are looking to bolster the Treasury General Account, or TGA, after the agency’s cash balance fell to the lowest since 2015 — just before President Joe Biden’s Saturday signing of a bill suspending the debt limit last week. The cash balance on Monday rose to its highest level in two weeks. Deutsche Bank expects the Treasury’s cash buffer will be just shy of $500 billion by the end of the month before ballooning to $600 billion at the end of September.

On Tuesday, the Treasury boosted the size of its shortest tenor benchmark bill auctions as the government works to quickly rebuild its cash cushion.

The flood of new bills is expected to create a drain on the banking system – which is already struggling to retain deposits – as buyers funnel cash into money-market funds. Some strategists have been making the case that the rapid rebuilding of the US stockpile will drive a liquidity drawdown and in turn a roughly 5% drop in the S&P 500 Index.

Read more: Trillion-Dollar Treasury Vacuum Coming for Wall Street Rally

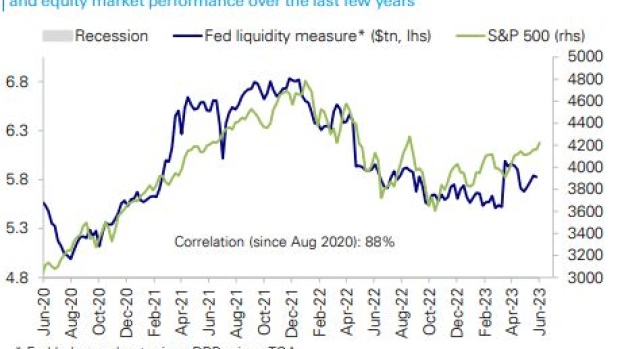

The notion that stock market moves and the Fed’s liquidity are tied gained credence during the global financial crisis as central banks enacted a series of unconventional monetary policy decisions that included multiple rounds of quantitative easing. The idea picked up steam in 2020 amid the Covid-19 pandemic as retail traders gathered force in the stock market and a sharp correlation arose between liquidity and market moves that August.

But for the first part of 2020, that correlation was negative and before the financial crisis, there was none at all, according to a Deutsche Bank analysis.

“The inconsistency of the correlation between Fed liquidity and equity returns reflects that it is in fact largely spurious,” the Deutsche Bank strategists wrote in a research note dated Monday.

Instead, the market is “arguably overdue” for a selloff since a 3% to 5% pullback in equities happens every two to three months, they said. Investors might be better served by focusing on measures of macro growth when trying to gauge the stock market. Those ties are “strong, intuitive, and consistent” with a relationship that spans decades, according to the strategists.

“We don’t think there’s a mystery that needs to be explained through this sort of esoteric force called liquidity,” Thatte said.

©2023 Bloomberg L.P.