Feb 13, 2024

Stock Momentum Slams Into a Wall in S&P 500’s Worst CPI Day In Years

, Bloomberg News

(Bloomberg) -- The S&P 500 Index blew past a series of troubling markers in its relentless rally to 5,000. Now, after Tuesday’s rout, investors are staring at a potentially long way down before they find support.

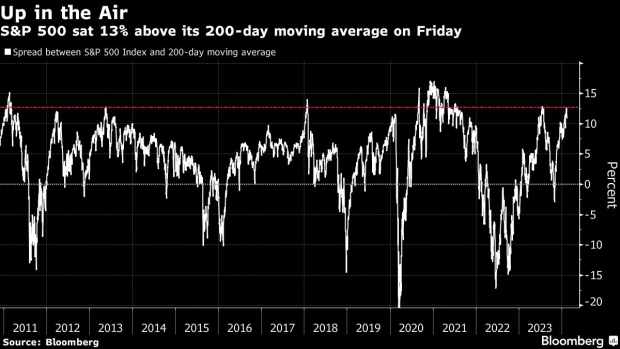

Signs of over exuberance are everywhere: The S&P 500s 15-week rally, in which it gained 22% through Monday’s close, pushed the gauge 13% above its 200-day moving average, something that has occurred on just 5% of the trading days this century. Hedge funds’ exposure to money-losing tech firms is hovering near a two-year high. And across the stock market, positioning is stretched and demand for loss protection muted.

The cold water to douse those flames arrived Tuesday morning in the form of data showing inflation remains stickier than expected. The rally that had been predicated on the belief that the central bank’s imminent pivot to interest-rate cuts slammed into reality, as those bets are being frantically rolled back.

“The data put in doubt investors’ optimism that the central bank’s interest-rate cuts are basically a done deal,” Chris Zaccarelli, chief investment officer at Independent Advisor Alliance LLC, said by phone. “It reinforced the idea that interest-rate cuts are not coming any time soon. And if that’s the case, all of a sudden the stock-market rally is looking stretched.”

The risk-off momentum pushed the S&P 500 down 1.4% on Tuesday, its worst CPI—day performance since September 2022. The Nasdaq 100 Index fell 1.6%, while the stocks with the highest short interest dropped 5.5% in the biggest loss in almost a year. Roughly 91% of the stocks on the New York Stock Exchange traded lower, the most since March 2023.

Whether this rout continues is anyone’s guess — but a 13% gap between the S&P 500 and its 200-day moving average historically is a bad sign. The setup preceded losses for the S&P 500 in 2011, 2015 and 2018, data compiled Andrew Thrasher, technical analyst and portfolio manager at Financial Enhancement Group, show.

“The spark for this selloff is the inflation data, but coming into this week, momentum was already pretty stretched,” Thrasher said by phone. “The rubber band can only go so far, and the momentum for many stocks was showing signs of exhaustion.”

What’s next? A line of defense for the S&P 500 could be at 4,909, its 20-day moving average, Thrasher said. Its 50-DMA will be another critical milestone. After that, traders will watch this year’s intraday low of 4,682 on Jan. 5. And then it’s the 4,600 level, which capped the S&P 500’s rally in July but ultimately yielded to the risk-on momentum in December as the gauge powered to new highs.

Read: US Inflation Tops Forecasts in Blow to Fed Rate-Cut Hopes

Another issue for bulls is that that fewer stocks have been participating in the rally this year, which could worsen the pain as indexes decline. Some 51% of stocks in the S&P 500 Index are trading above their 50-day moving average, the fewest since November.

That said, there are signs of fundamental strength. Corporate America’s profit machine keeps chugging, the US consumer is solid and unemployment remains in check. But a relative lack of hedging demand amid a 15-week, 22% S&P 500 rally is a worrisome sign of complacency. The so-called put-to-call skew on the Top 50 stocks in the S&P 500 is approaching the level last seen in the first quarter of 2021.

“Market participants had been conditioned to expect a linear decline in inflation,” said Mark Luschini, chief investment strategist at Janney Montgomery Scott. “They were hoping numbers would cooperate with a glide path toward a 2% target, leading to the rate cuts that the market had priced in.”

--With assistance from Hema Parmar.

©2024 Bloomberg L.P.