Nov 15, 2022

Stock Traders Seize On Inflation Signal They Needed for a Rally

, Bloomberg News

(Bloomberg) -- Stock investors are beginning to see a glimmer of hope as signs of peak inflation appear.

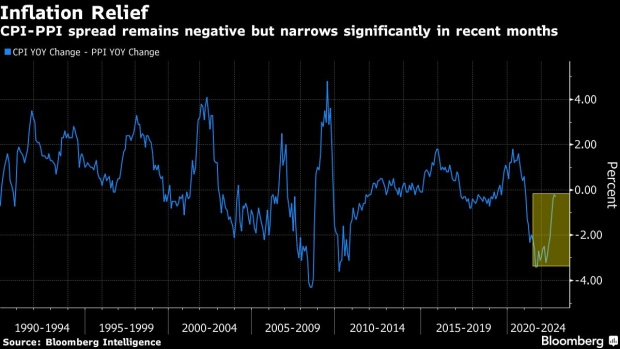

A once wide gap between rising consumer and producer prices has significantly narrowed since March. That should calm fears about runaway inflation since it will help Corporate America improve its profit margins -- and potentially get US stock prices climbing again.

US producer price growth decelerated in October, the latest sign that elevated inflationary pressures are beginning to ease. Stocks advanced on Tuesday as the data revived hopes that inflation may be nearing a peak. It follows last week’s cooler-then-expected consumer price reading, which triggered the biggest CPI day gain on record for the S&P 500 Index, according to Bloomberg Intelligence data going back two decades.

If producer prices continue to fall in the coming months, that could help support corporate earnings and, in turn, US equities, since a further deceleration in inflation would take some of the urgency off the Federal Reserve to extend jumbo rate hikes beyond this year, according to Gillian Wolff, senior associate analyst at Bloomberg Intelligence. Ideally, that would also help ease constraints on stock prices, she added.

“CPI needs to be higher than PPI to alleviate some of the pressures on company margins near term though, and that still hasn’t happened,” Wolff explained. “This is telling us that input costs for companies are still rising faster broadly than costs for the consumer goods they sell.”

In the decade leading up to the Covid-19 pandemic, forward 12-month operating margins for S&P 500 companies typically expanded alongside consumer prices. But a closer look shows the moves were more positively correlated with the spread between consumer- and producer-price indexes than to the CPI alone, according to BI.

That spread is currently negative, with producer costs rising faster than the prices that companies charge consumers. But it has been narrowing significantly from negative 3.4% in September 2021 to negative 0.3% last month, a vast improvement from the summer where the gauge was in the low single digits.

Negative spreads historically point to lower equity returns, while flat or higher spreads typically mean stronger gains for stocks. The S&P 500’s average monthly margin growth in the past three decades stands at 1.4%, according to BI.

In the years after the CPI-PPI spread fell below zero, margins for the index grew by only 1.1% on average, compared with 4.2% when it was above that threshold. On average, one year after the CPI-PPI spread slid below zero, returns for the index were half as strong as when the spread was at least flat, BI data show.

“August through October has been the same regime: close to zero on the spread, but still not able to go positive,” Wolff said. “If the spread continues to improve, that’s definitely moving in the right direction, but ideally it should be positive.”

©2022 Bloomberg L.P.