Feb 1, 2023

Strikes Hurt London’s Restaurants as Workers Stay at Home

, Bloomberg News

(Bloomberg) -- Britain’s pubs and restaurants fear this week’s strikes will cost them £100 million ($123 million) in sales, with London’s establishments shouldering most of the impact.

Almost half a million British teachers, train drivers and civil servants walked out on Wednesday in protest against real-terms pay cuts. It’s the largest single-day strike in a wave of industrial action that has been growing since the summer.

Strikes are estimated to have cost the UK economy £1.5 billion last year, according to Bloomberg Economics.

Separately, to measure the immediate impact of Wednesday’s industrial action in the capital, we have taken a snapshot of London data on road traffic levels, restaurant bookings, retail footfall, train journeys and the cost of a minicab.

Here’s what we found.

Hospitality Hit

With many City staff working from home, London’s restaurants and bars had another quiet day. The industry has been particularly affected by rail strikes that reduce the number of people traveling into city and town centers.

Demand for lunch reservations in central London halved compared with last week, according to data from booking platform TheFork, which measures how many restaurants still have spare tables.

“The situation provides yet another pressure for a sector contending with soaring energy costs, workforce challenges and dampening consumer confidence,” said UKHospitality Chief Executive Officer Kate Nicholls.

Rail strikes have already cost hospitality businesses around £2.5 billion in lost revenue since last summer, Nicholls added.

Retail Woe

Shops in central London suffered another sharp drop in customers due to today’s strikes, while other city centers across the country were also hurt.

With few trains running, Britain’s main shopping streets took a hit according to data firm Springboard which measured footfall up until noon. Its data showed that people turned to shopping centers and retail parks instead, while stores in outer London probably benefited from more workers staying at home in traditional commuter neighborhoods.

“The upcoming rail strikes will be damaging for retail, as the strikes limit commuter, leisure and tourist traffic,” said Kris Hamer, director of insight at the British Retail Consortium. “UK footfall remains down on pre-pandemic levels, and this will only slow the progress retailers have made to bring people back to stores.”

Demand for Taxis

Demand for minicabs increased this morning as people contended with a lack of trains.

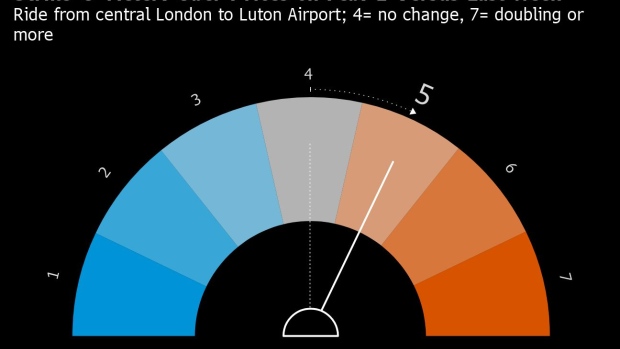

An Uber ride from central London to Luton Airport at 8 a.m. came with a price tag of £105, up 25% from the same time-frame a week ago, according to data compiled by Bloomberg.

Congestion

Rail strikes often push more cars on to Britain’s roads. However, Wednesday’s congestion was less severe than on average, according to TomTom data — at least in the capital. On average, Londoners spent 10% less time per trip during the morning rush compared with last Wednesday.

The teachers’ strike is likely to have convinced many parents to work for home, removing the need for a school-run or indeed any journey.

“Workers have become accustomed to the disruption and are planning their commute accordingly or are staying at home altogether,” said Andy Marchant, traffic expert at TomTom.

The Big Picture

As with previous train drivers’ strikes, the rail network was largely brought to a standstill, with no services at all from core terminals such as London Victoria.

Restaurant bookings in the city center were sharply down, but congestion was lighter on the roads. Londoners have become used to strikes over several months, with those who are able to work from home simply getting on with the job.

(Updates with section on retail sector.)

©2023 Bloomberg L.P.