Sep 19, 2022

Sweden Gets Ready for the Biggest Rate Hike This Century

, Bloomberg News

(Bloomberg) -- The Riksbank will lead the global charge against inflation this week with an aggressive interest-rate increase that is likely to be its biggest in almost three decades since the Swedish central bank introduced its current policy setup.

While most economists reckon the Stockholm-based central bank will follow the European Central Bank and deliver a 75 basis-point hike, several say a bigger move can’t be excluded. Either option would amount to the largest increase since the Riksbank’s current policy regime, with a 2% inflation-target, was established in the 1990s.

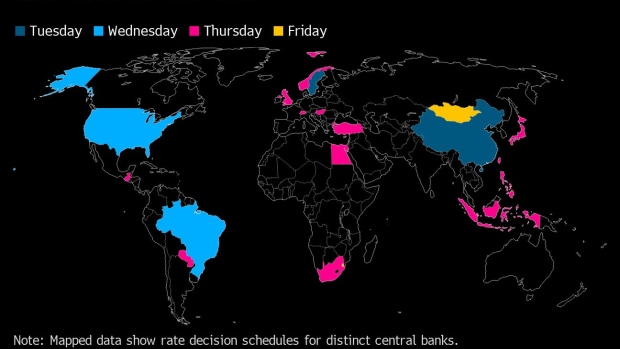

A 100 basis-point hike would make Sweden only the second in the Group of 10 jurisdictions with the world’s most-traded currencies to make such a move this year -- after the Bank of Canada in July. It might also set the tone for a bumper week of policy making, with some investors speculating that the US Federal Reserve could do the same on Wednesday.

Either way, a large increase by the Riksbank will demonstrate heightened alarm at inflation that officials were late to grasp and react to in the Nordic region’s largest economy. At 9%, it’s at a three-decade high and has exceeded the central bank’s forecasts for 11 months in a row.

Governor Stefan Ingves conceded earlier this month that after underestimating inflation, small increments in rate hikes may not suffice. He also said that previous guidance for a half-point hike this week is no longer valid.

The Riksbank is facing a dilemma familiar to its global peers, of how to curb inflation without too much harm to the economy. That’s especially acute in Sweden, where household indebtedness is high and more than 40% mortgages feature rates that are set for periods of no more than three months.

The turnaround in monetary policy has already made a dent in a previously booming housing market, with home prices falling steadily from a peak earlier this year.

What Bloomberg Economics says...

Our forecast puts the Riksbank policy rate at 2.25% at year-end. Uncertainty around energy prices and rising utility costs -- especially for southern Sweden, where electricity prices have nearly tripled over the month in August -- pose upside risks to this outlook.

--Selva Bahar Baziki, Sweden and Turkey economist. To read the full report, click here

While the risk of a full-percentage point hike has increased, it may a step too far for Ingves and his colleagues, according to Swedbank Chief Economist Mattias Persson. He reckons such a large hike would hurt households now postponing major spending amid pressure from energy costs.

“The economy is already slowing down, especially when it comes to consumption,” he said in a phone interview. “We have also seen companies such as Electrolux and Thule warn on profits, and announce cost savings.”

An argument in favor of a 100 basis-point move is that the strength of inflation has left officials finding themselves way behind the curve, Persson added.

More aggression could also help the Riksbank damp imported inflation. While board members have largely avoided commenting on declines in the krona, Deputy Governor Martin Floden said last month that the currency is “way too weak,” and that it should strengthen based on expectations that the Riksbank will act more decisively than the ECB.

Since then, the krona has lost more ground against the euro as well as the dollar, and it is the second-worst performer of major currencies this year. Nordea’s chief analyst Torbjorn Isaksson says the exchange rate posed “a dilemma.”

The krona “may weaken if the Riksbank does not hike the policy rate sufficiently,” he said. “On the other hand, significant rate hikes could break the housing market.”

©2022 Bloomberg L.P.