Apr 1, 2023

Switzerland Well-Placed to Weather Bank Turmoil, Economists Say

, Bloomberg News

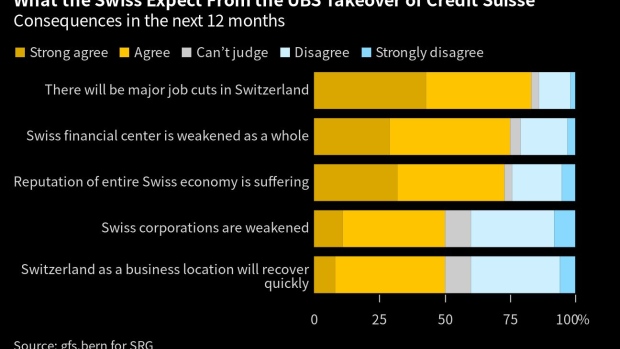

(Bloomberg) -- UBS Group AG’s hastily brokered takeover of Credit Suisse Group AG and the job cuts likely to follow are undoubtedly a blow for Swiss self-esteem as a global financial center, yet the wider economy looks well-placed to weather the fallout.

Low federal debt levels, the strength of the Swiss franc and a flexible labor market with comparatively little employment protection act as built-in stabilizers, according to Christian Schulz, deputy chief economist for Europe at Citigroup Inc.

This gives the government financial headroom to weather crises, while the currency attracts investors as a safe haven.

“It’s certainly a shock for the financial system,” said Schulz. “But the effect on the Swiss economy won’t be too big. That’s shown by the evidence from 2008.”

Fifteen years ago, UBS was itself the subject of a state bailout during the global financial crisis. And yet the impact on growth was three times less than in neighboring Germany, with a drop in gross domestic product of 2.2% in 2009 compared with almost 6%.

Since then, the Swiss financial services sector’s contribution to GDP has fallen to 5.6% overall, with a handful of large banks accounting for just 1.2% in 2020. This is far below the 4.8% from the pharmaceuticals industry and 3.2% from watch companies.

“When looking at overall value added created by all banks operating in Switzerland, the share of the big banks has been on a downward trend since 1995,” according to the government.

UBS and Credit Suisse combined nonetheless have assets worth more than twice the country’s annual output.

As for potential job losses, the figures seem daunting. Out of a total of some 90,000 workers at Switzerland’s banks, around 23,000 work at big institutions, according to the Swiss National Bank.

Credit Suisse was already laying off 9,000 of its 50,000 staffers globally before the takeover. Significant business overlaps mean total job cuts ultimately may reach a multiple of that, according to one person familiar with the discussions.

While not all dismissals will happen in Switzerland, financial sector employment in Switzerland is set to take a hit.

Still, the mobility of the labor market, as well as record-low unemployment of 1.9%, protect the Swiss economy, VP Bank AG Chief Economist Thomas Gitzel said. He estimates there will be a slight uptick in the short run in the worst case, with no effect on the long-term jobless rate.

Bankers are highly qualified and highly mobile, he said, adding: “I’m quite confident that they will have the chance to find work somewhere else.”

The creation of what Gitzel described as a “juggernaut,” carries uncertainties, however, including limited competition for international banking operations such as share emissions or large syndicated loans, and a potential impact on corporate funding.

“The direct fallout will be limited, but the indirect impact on household and corporate confidence is difficult to quantify,” said Nadia Gharbi, senior economist at Banque Pictet & Cie SA.

As of now, none of the three economists who spoke to Bloomberg have changed their growth forecasts for Switzerland.

©2023 Bloomberg L.P.