Feb 28, 2023

Target Tempers Strong Fourth Quarter With Cautious Forecast

, Bloomberg News

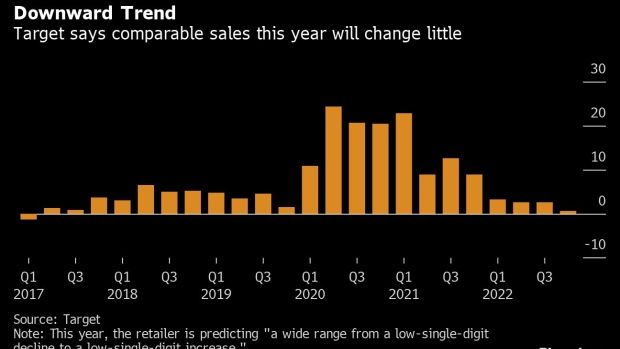

(Bloomberg) -- Target Corp. turned in a strong fourth-quarter performance and tamed an inventory surge that had marred results earlier last year, boosting investor bets that the retailer is on track for a moderate recovery.

Adjusted fourth-quarter earnings of $1.89 handily surpassed the $1.48 average analyst estimate compiled by Bloomberg, and inventory of discretionary goods — the source of painful markdowns last year — fell sharply. Target also bucked projections for a decline in comparable sales, thanks to a slight increase in customer traffic.

The results position Target for a rebound this year, albeit a modest one: The company said adjusted earnings would rise to no more than $8.75 a share from $6.02 in 2022, trailing the $9.25 average of analyst estimates compiled by Bloomberg. The muted outlook echoed the message from Walmart Inc.’s earnings report last week, as US retailers ring up sales even as consumer sentiment flags amid a cloudy economic outlook.

“The biggest variable is just, what is the path of the consumer?” Chief Financial Officer Michael Fiddelke said at a meeting of Target executives with investors and analysts in New York. “It’s an uncertain environment and we want to plan cautiously.”

The shares rose 2.4% at 11:47 a.m. in New York. Target climbed 12% this year through Monday, in line with the gain in an S&P index of US consumer-discretionary companies. The shares plunged 36% last year, Target’s worst annual decline since at least 1981.

Target’s outlook underscores the mixed signals from US shoppers. Consumer confidence unexpectedly fell in February, as rising prices and deepening concerns about the outlook outweighed the benefits of a solid labor market.

“Walmart and Target both easily beat expectations in Q4 but offered a gloomy outlook for 2023,” Stephen Stanley, an economist at Santander, said in a note. “Everyone is braced for the worst, but, as the January data on employment, consumer spending, etc. show, so far, the economy is holding up well.”

Indeed, Target surprised analysts with the strength of its fourth-quarter results. Revenue climbed 1.3% to $31.4 billion, the company said in a statement. That surpassed Wall Street’s projections by almost $1 billion.

The Minneapolis-based retailer posted a comparable-sales gain of 0.7%, while analysts had projected a decline of 1.7%. Inventory fell 2.9% to $13.5 billion, a welcome relief after a jump of more than 40% early last year as demand for discretionary items weakened and unwanted merchandise piled up.

Surging inventory forced discounts on many goods and hammered profit margins earlier in 2022. In the fourth quarter, though, Target’s stockpile of discretionary merchandise fell about 13% — a sign the retailer is bringing the problem under control.

Profitability Outlook

A year ago, Target predicted that operating income would reach 8% of revenue in the fiscal year ending in early 2023, and Wall Street has homed in on that metric to assess the company’s profitability. But last year’s actual operating margin turned out to be 3.5%, while adjusted earnings were less than half of 2021’s total.

Target is predicting a gain in operating income of more than $1 billion this year, which would lift the total to at least $4.8 billion. That implies an operating margin of a little more than 4%, based on analysts’ sales estimates.

Over the next three years, Target said its operating margin would reach and then exceed its pre-pandemic rate of 6%. Indeed, the company said it could attain that level as soon as the fiscal year that ends in early 2025. That would depend “on the speed of recovery for the economy and consumer demand.”

Last year, Target said it gained market share in all five of its merchandise categories in terms of units sold, as opposed to dollar sales. That’s a key gauge it’s watching this year as it seeks to engage customers and work its way back from last year’s woes.

Target’s outlook was “better than feared,” Rupesh Parikh, an analyst at Oppenheimer & Co., said in a note to clients. “We believe the elements are clearly now in place for a multiyear profit recovery.”

--With assistance from Cécile Daurat.

©2023 Bloomberg L.P.