Nov 1, 2022

Tech Stocks Not in 2000-Style Bubble, Evercore Strategist Says

, Bloomberg News

(Bloomberg) -- Evercore ISI’s Julian Emanuel says technology stocks are not in a dotcom-era bubble and should eventually resume their climb.

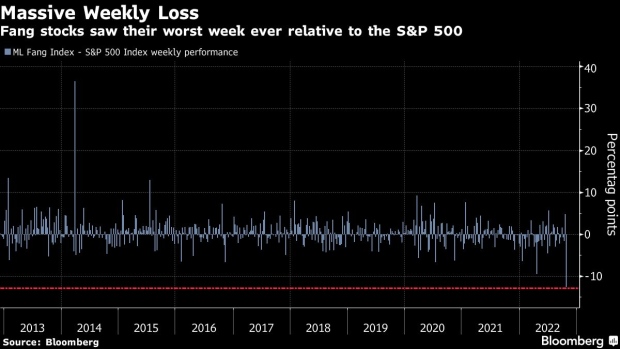

“This is not like 2000,” the firm’s chief equity & quantitative strategist said Tuesday on Bloomberg Surveillance. “Over the last 10 years we have gotten to this point where the returns were driven by a handful of stocks,” he said pointing to the so-called FAANG stocks; Facebook parent, Meta Platforms Inc., Amazon.com Inc., Apple Inc., Netflix Inc. and Alphabet Inc.’s Google, which at one point made up a quarter of the benchmark S&P 500 Index’s weighting.

He expects tech shares to trade sideways until earnings catch up to valuations and the group takes another leg higher, a familiar pattern for FAANG stocks. “Long-term, those are still secular growers; they’re just not going to prop up the market to the extent that they have.”

Following mostly disappointing third-quarter earnings and guidance, big tech companies were caught in a selloff that wiped out as much as $370 billion of value. The sector continues to weigh heavily on the broader market, on Tuesday the S&P 500 ended the session 0.4% lower with Amazon, Apple and Microsoft the biggest drags on the benchmark.

The crisis in megacap tech stocks has roiled investor confidence at a time when bond yields are falling and the Federal Reserve forges on with its most aggressive tightening campaign in decades. The sector, which was a popular place for traders to invest in during the pandemic, has been among this year’s biggest laggards as rising rates crimp growth.

Emanuel expects more volatility for the broader market as investors look to Fed Chair Jerome Powell to offer more clues into the central bank’s policy direction at the conclusion of a two-day Federal Open Market Committee meeting Wednesday. Traders are largely anticipating a 75-basis point rate hike, and also looking for signals of a slower pace on further increases. They are also closely watching the Nov. 8 midterm elections.

“The next week or two could be very choppy,” Emanuel said. “We know the Fed is about to downshift. I don’t want to call it ‘pause’ or whatever. But we know the trajectory is going to change and the market is getting comfortable with that.”

Similar to the July earnings season, investors know that estimates need to come down, he said. “But it didn’t matter to stocks in July, and it doesn’t matter now because, frankly, people have been for the most part underinvested,” he said.

US stocks have been whipsawed over the past few weeks though they ended October higher. The benchmark is up 8% from a two-year low reached on Oct. 12, the day before data showed inflation had surged to a 40-year high.

--With assistance from Tom Keene and Jonathan Ferro.

(Updates with end of day trading in paragraph four.)

©2022 Bloomberg L.P.