Oct 24, 2019

Tesla shares top street targets for first time since January

, Bloomberg News

Tesla surges after surprise profit

Tesla Inc. shares are now trading above Wall Street expectations after spending most of the year languishing below analysts’ average price targets.

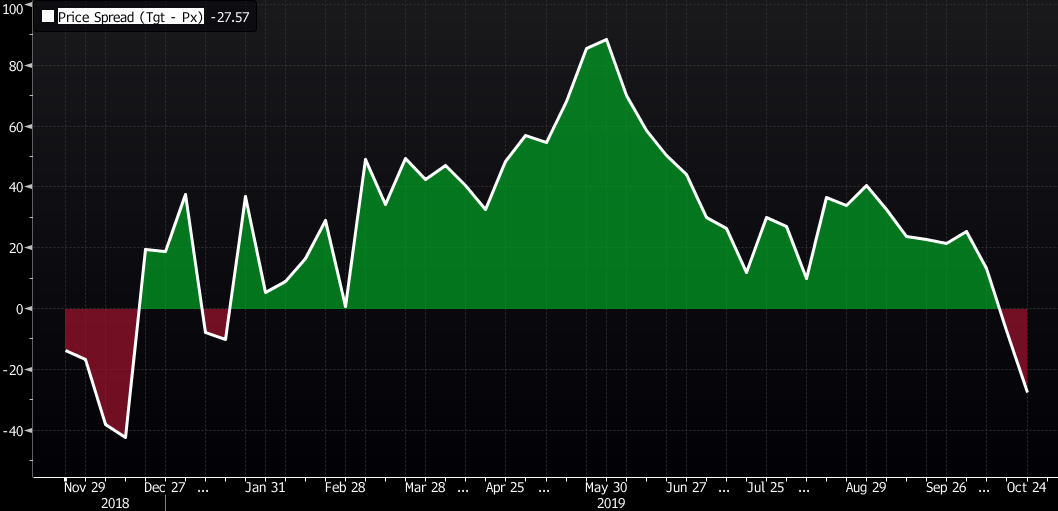

The company’s share price is currently hovering around US$299, while the average analysts’ price target stands at US$268, according to Bloomberg data. The last time the shares were trading above expectations was in January.

As the chart below shows, the spread between average analysts’ price target and Tesla’s share price turned negative today, as the price exceeded the average target.

Until the surprise profit reported on Wednesday, the year had been riddled with challenges and setbacks for Tesla, as investors grew increasingly concerned about demand for its electric cars, and the company’s ability to make money and continue building the vehicles. Those worries also reflected in the stock, which was down over 23 per cent this year before Thursday’s gains.

If Tesla shares manage to hold on to the gains for a few more days, there might be a slew of price target raises over the next few weeks.