Jul 27, 2022

Tether Says There Is No Chinese Corporate IOUs Among Its Reserves

, Bloomberg News

(Bloomberg) -- Tether said the reserves backing its $66 billion stablecoin do not contain any Chinese commercial paper, likely marking the first time that the issuer of the world’s most used cryptocurrency explicitly stated it doesn’t hold the controversial assets.

Tether Holdings Ltd., which issues and operates the US dollar-pegged token USDT, had most recently refuted speculation that its token was 85% backed by Chinese or Asian commercial paper in June. It has been steadily decreasing its exposure to commercial paper in favor of holding US Treasury bills, with a goal of reducing its paper holdings to zero by early November.

USDT aims to maintain a one-to-one peg with the dollar by relying on a reserve of cash or cash-based equivalents, though the quality of those assets have previously been called into question. A Bloomberg investigation last year found evidence that Tether’s reserves included short-term loans to large Chinese companies. A downturn in the Chinese property market raised concern about the liquidity of assets associated with the sector.

Alex Welch, a spokesperson for Tether, said in an emailed statement that the firm discloses its reserves of CP “to the rating level,” pointing to quarterly attestations filed by its accounting firm. “When we had commercial paper, we always remained conservative and these were rated A2 or better from agencies such as Fitch and Standard and Poor’s,” Welch added.

As of Wednesday, Tether said in a blog post that it now holds around $3.7 billion in commercial paper, down from $8.4 billion at the start of July and around $20 billion in March.

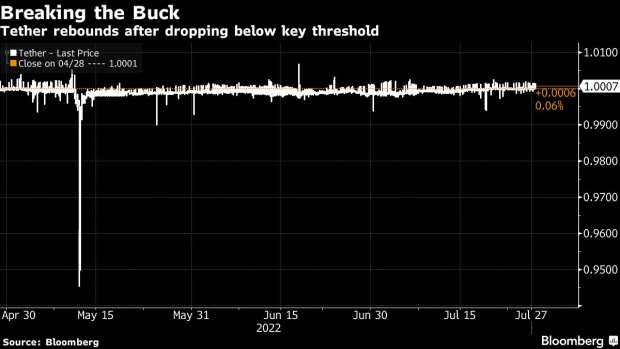

The stablecoin has sought to maintain its dollar peg as the crypto market soured, briefly falling as low as 94 cents during the height of the crash in mid-May. Data from blockchain analysis firm Kaiko showed USDT had traded at a discount to $1 for more than 60 days since that time, but regained that level last week.

Tether began to provide quarterly reports on its reserves to New York last year as part of a settlement over allegations that it hid the loss of funds and lied about reserves in prior years. A March 2021 disclosure that Tether held commercial paper triggered a guessing game in both the crypto and fixed income world as investors tried to figure out what securities were held beyond the amounts listed.

Several countries have announced plans to regulate the stablecoin sector in the near term, including the US, the UK and Japan. Rules could include a requirement that operators are more transparent about the assets backing their tokens, as well as bringing them under existing non-bank licensing regimes.

©2022 Bloomberg L.P.