Oct 3, 2017

The benefits of debt-fueled growth don’t last forever: IMF

Economic growth propped up by debt-fueled consumer spending increases the risk of a major financial collapse, according to a new report by the International Monetary Fund.

The latest edition of the IMF’s Global Financial Stability Report examined the relationship between household debt and consumer spending, and showed that near-term economic growth bolstered by borrowing often leads to medium-term costs associated with higher debt levels, especially in advanced economies.

“In the short term, an increase in the household debt-to-GDP ratio is typically associated with higher economic growth and lower unemployment, but the effects are reversed in three to five years,” according to the report.

“Moreover, higher growth in household debt is associated with a greater probability of banking crises. These adverse effects are stronger when household debt is higher and are therefore more pronounced for advanced than for emerging market economies, where household debt and credit market participation are lower.”

The report offered some staggering differences between Canadian and U.S. households, which highlight the precarious position of many consumers north of the border.

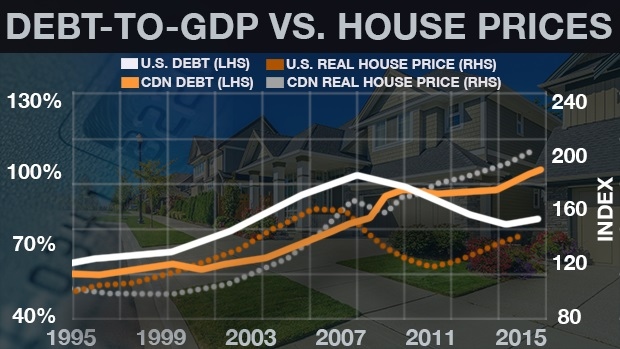

“Until the global financial crisis, household debt levels evolved very similar in the United States and Canada,” the report said. “U.S. household debt increased from 56 per cent in 1995 to nearly 100 per cent of GDP in the first quarter of 2008 and from 62 per cent to 80 per cent in Canada. Afterward, U.S. household debt fell below 80 per cent by early 2017, whereas in Canada, it continued to rise to more than 100 per cent.”

The difference can be explained primarily by the U.S. housing crash, which forced households to deleverage. No such process happened in Canada, which has resulted in higher debt levels across all income levels, especially in the top 20 per cent – a key factor in the report’s position that the risk profile of debt shifts in the medium-term.

“High leverage may expose households to potentially adverse income shocks. The past recession in the United States showed that highly indebted households substantially reduced spending, which contributed to a significant decline in aggregate [economic] demand,” the report said.

The findings are in line with analyses from the Bank of Canada, which has repeatedly cited household debt and housing market risks as major vulnerabilities. The question for investors remains: what is the economic tipping point, and what, if anything, will trigger it?

GDP growth this year has been strong, reaching an annualized 4.5 per cent in the second quarter. However, many economists believe growth will moderate from here on out. And many, including the IMF, agree that Canada has taken some prudential actions to reduce the threats facing the economy and financial system.

“Country characteristics and institutions can mitigate the risks associated with rising household debt,” the report said. “Even in countries where household debt is high, the growth-stability trade-off can be significantly mitigated through a combination of sound institutions, regulations, and policies. For example, better financial regulation and supervision, less dependence on external financing, flexible exchange rates, and lower income inequality would attenuate the impact of rising household debt on risks to growth.”