Dec 13, 2023

The Oil Market’s Latest Setback: Contango Everywhere

, Bloomberg News

(Bloomberg) -- For the first time in more than a year the oil market is flashing bearishness in every key global pricing hub.

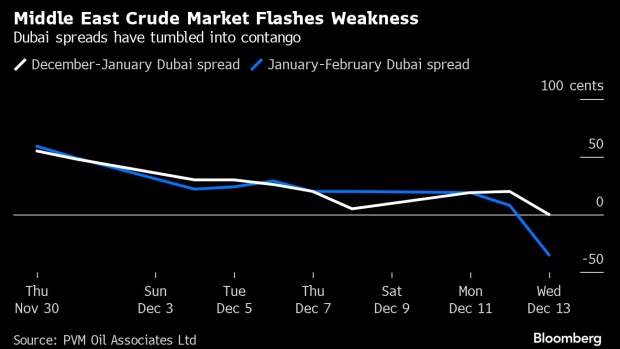

On Wednesday, several Dubai crude timespreads flipped into contango, a structure where nearby prices trade at a discount to later ones, after similar moves in the Brent and West Texas Intermediate benchmarks. As well as pointing to an oversupplied market, contango also tends to provide trend-following funds with a signal to sell more futures.

Crude markets are being pressured by higher supplies, particularly exports from the US, which have countered a decision by OPEC+ producers to curb output. It’s a weakness that has helped drag headline Brent futures prices to the lowest since June.

Until now, Dubai spreads had been trading in the opposite structure, known as backwardation, all year. That was a result of supply curbs from OPEC+, which reduced supplies of the heavy sulfurous — or sour — crude pumped in the Middle East and shipped mainly to Asia.

“It was the strongest and most supply-starved crude out there, and yet here we are,” said Keshav Lohiya, founder of consultant Oilytics. “It’s possible sour markets are not as tight as previously thought, with a potential slowdown in Asia.”

On Wednesday, the nearest two Dubai swaps were trading at parity with one another, according to data from brokerage PVM Oil Associates Ltd. But the subsequent five spreads were all in contango, the first time there’s been such a market structure in Dubai since late last year, according to data compiled by Bloomberg.

In another sign of a softening Asian market, Oman crude is also trading below the Dubai benchmark for the first time since November. Physical markets have generally remained well supplied in the face of softening oil demand in the region, traders said.

©2023 Bloomberg L.P.