Dec 7, 2021

The UAE Switches Weekend: Here’s What Analysts Are Saying

, Bloomberg News

(Bloomberg) -- The United Arab Emirates plans to switch its weekend to Saturday-Sunday from the start of next year, a step that aligns the Gulf country with most global markets.

Ehsan Khoman, head of emerging market research for Europe, Middle East and Africa at MUFG Bank in Dubai:

- “The change in the working week is a further step in the country’s encouraging liberalization laws, which will more closely align, particularly the financial sector, with global real-time trading platforms, enhancing efficiencies and further unlocking economic growth.”

Mohammed Ali Yasin, chief strategy officer at Al Dhabi Capital:

- “There should be clarifications for specific sectors that rely on federal or government entities being open Friday afternoon in order to fulfill their commitments to their clients, such as the central bank.”

- “The stock markets’ operating hours also need clarification. Will the trading hours on Friday be cut to comply with the half-day rule?”

Hasnain Malik, head of research at Tellimer in Dubai:

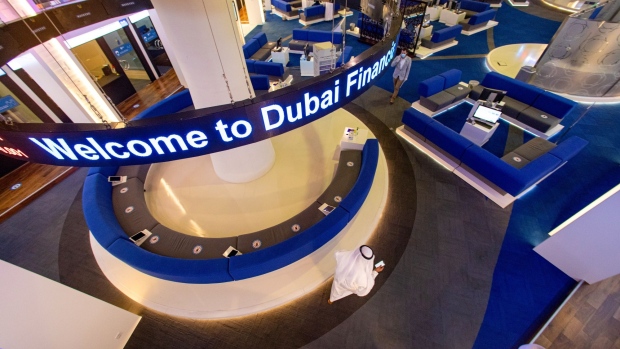

- “An extra synchronized day with global markets likely makes little or no difference to trading levels on the Dubai Financial Market or the ADX General Index. These markets are mainly driven by locals or passively managed foreign funds.”

- “The shift of the week may make for more activity for firms in the broader economy geared to global markets but the difference is marginal.”

Pedro Gomes, an economist at Birkbeck, University of London, and author of the book “Friday is the New Saturday,” on Twitter:

- “Starting by the public sector is a tactical mistake. It will exacerbate the narrative of hardworking private sector versus lazy bureaucrats. This is why the Utah 2011 4-day week failed. It should be implemented to the whole economy, giving 4/6 years for the adjustment.”

©2021 Bloomberg L.P.