Dec 15, 2023

The Year of Nvidia, AI Stocks and Lofty Valuations

, Bloomberg News

(Bloomberg) -- The world’s most valuable technology firms have powered the Nasdaq 100 index toward its best year in more than a decade, as investor appetite for artificial intelligence overwhelmed concerns about the impact of higher interest rates in 2023.

And there was no other company that embodied the excitement about AI and actually delivered on that promise like Nvidia Corp. Its 230% advance has made it the best performer by far in the both the Nasdaq 100 and the S&P 500 Index.

Below is a look at the year in charts, reflecting analysts’ bullish views toward Nvidia, the Nasdaq 100’s gains, the dominance of the seven-biggest technology and internet related stocks, and the tech-sector’s lofty valuations.

Nvidia Moonshot

While there is still plenty of debate about whether Nvidia’s stock is too expensive or cheap, one thing is certain: Wall Street analysts see no end for the unprecedented surge in profits that has fueled the run. The firm is expected to generate about $48 billion in profit over the next 12 months, up from expectations of about $10 billion at the start of the year.

Nasdaq Powers Through High Rates

A steady climb in interest rates for most of the year proved to not be the threat to the sector that many thought it would be. Instead, the Nasdaq 100 continued to rise despite the yield on the 10-year US Treasury yield staying above 4% for most of the year. The strength was fueled by rising profits after companies slashed tens of thousands of jobs and reined in spending. Technology stocks have lifted off recently on signs the Federal Reserve is done with its historic policy tightening campaign.

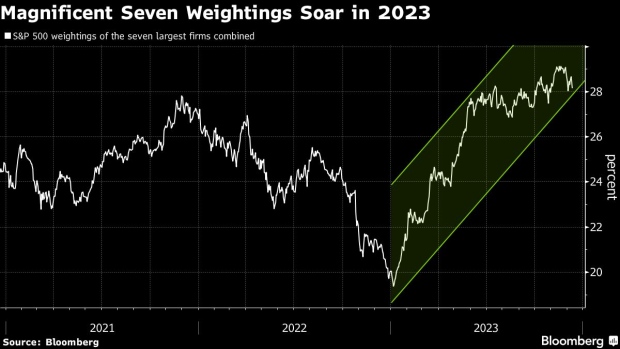

Bigger Than Ever

The seven biggest technology and internet related stocks — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia, Meta Platforms Inc. and Tesla Inc. — saw their combined weighting in the S&P 500 rise to a record 29% in November. Investors flocked to them in part on bets that they are best positioned to capitalize on artificial intelligence due to their vast scale and financial strength. The cohort accounts for about two-thirds of the benchmark’s 23% gain in 2023.

Stretched Valuations

Those bigger profits have brought valuations down from nosebleed levels but they’re still lofty. The Nasdaq 100 is priced at about 25 times profits projected over the next 12 months, according to data compiled by Bloomberg. While that’s down from a peak of 30 in 2020, it’s well above the average of 19 times over the past two decades.

Top Tech Stories

- Intel Corp., the biggest maker of personal computer processors, announced new chips for PCs and data centers that the company hopes will give it a bigger slice of the booming market for artificial intelligence hardware.

- Alphabet Inc.’s Google is changing its Maps tool so that the company no longer has access to users’ individual location histories, cutting off its ability to respond to law enforcement warrants that ask for data on everyone who was in the vicinity of a crime.

- Rocket Lab USA Inc. blasted off for space for the first time since its September failure, in a key test of the company’s ability to challenge SpaceX’s dominant Falcon 9.

- Chinese microblogging site Weibo Corp. is asking some of its users not to post negative content about the economy, a move that underscores concerns about sputtering domestic growth.

Earnings Due Friday

- No major earnings expected

--With assistance from Ryan Vlastelica, Subrat Patnaik and Carmen Reinicke.

(Updates stock move in paragraph two.)

©2023 Bloomberg L.P.