Apr 23, 2019

These Are the Asian Markets to Watch After Crude Oil’s Spike

, Bloomberg News

(Bloomberg) -- Energy is in focus this week as equity investors in several key Asian markets returned from holiday Tuesday to see crude oil prices have jumped to a six-month high.

Brent crude extended gains to $74.28 a barrel at 12:30 p.m. in Hong Kong, after climbing 2.9 percent Monday, as the Trump administration said it will no longer give China, India and other markets a pass on sanctions barring purchases of Iranian crude. In response, Iran threatened to shut the Strait of Hormuz, a key maritime chokepoint for Persian Gulf producers.

The energy sector was the biggest gainer in the MSCI Asia Pacific Index with a 1.2 percent advance, as the broader benchmark traded little changed. Australian, Hong Kong and New Zealand markets reopened after the Easter holiday, while Sri Lanka’s Colombo Stock Exchange remains shuttered following a series of terrorist attacks over the weekend that killed 290 people.

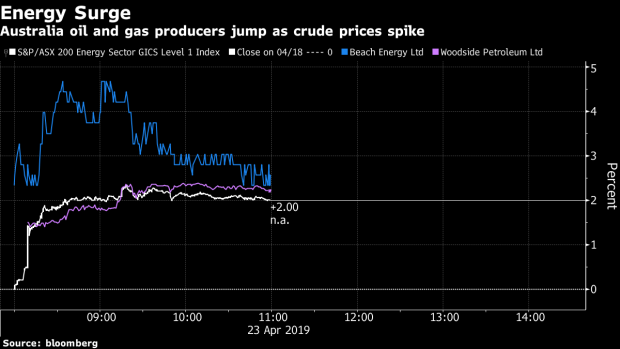

In Australia, energy stocks are also leading the way, boosting the broader benchmark with their more than 2 percent gain. Beach Energy Ltd., Santos Ltd. and Woodside Petroleum Ltd., the largest energy producer in the country, advanced at least 2.4 percent.

“There’s a bit of variance in views on the Australian economy, which domestically looks soft but is being helped by the export sector,” especially with stronger commodity prices, said Toby Lawson, managing director with Societe Generale SA, in an interview with Bloomberg Radio.

Australia’s energy sector is the second best-performing industry this year, underpinning gains in Australian equities amid a prolonged housing slump that’s weighed on business confidence and raised concerns about economic growth.

On the flipside, fears surrounding higher fuel costs have sent airline stocks in Asia lower. The Bloomberg Asia Pacific Airlines Index posted a 4.3 percent two-day decline as the price of oil surged. China Eastern Airlines, China Southern Airlines and Air China were the biggest losers today.

Another corner of the market that’s seeing a negative impact is oil importers including India and Indonesia. The benchmark S&P BSE Sensex Index tumbled the most in four months yesterday given oil is the country’s biggest import. The Jakarta Stock Exchange Composite Index meanwhile is recovering somewhat Tuesday, paring Monday’s 1.4 percent decline, its biggest in a month.

Reliance Industries Ltd., the second-largest weighting in the Sensex and operator of a petroleum refinery complex in India, posted its biggest loss of the year yesterday to lead declines, after touching a record high on April 1. Refiners Bharat Petroleum Corp. and Indian Oil Corp. also retreated at least 4 percent.

The India NSE Volatility Index, or India VIX, extended its climb to the highest level since February 2016 Tuesday as the surge in oil prices weighed more on market sentiment.

“The market is waking up to the fact that the external oil dependence is quite high” for India, said Maximillian Lin, emerging-markets Asia strategist at NatWest Markets in Singapore, speaking on Bloomberg Television.

Stock Market Summary

- MSCI Asia Pacific Index up 0.1%

- Japan’s Topix index up 0.2%; Nikkei 225 little changed

- Hong Kong’s Hang Seng Index little changed; Hang Seng China Enterprises down 0.5%; Shanghai Composite down 0.4%; CSI 300 little changed

- Taiwan’s Taiex index little changed

- South Korea’s Kospi index little changed; Kospi 200 little changed

- Australia’s S&P/ASX 200 up 0.8%; New Zealand’s S&P/NZX 50 up 0.6%

- India’s S&P BSE Sensex Index up 0.2%; NSE Nifty 50 up 0.2%

- Singapore’s Straits Times Index little changed; Malaysia’s KLCI up 0.2%; Philippine Stock Exchange Index down 0.7%; Jakarta Composite up 0.7%; Thailand’s SET up 0.2%; Vietnam’s VN Index little changed

- S&P 500 e-mini futures little changed after index closed little changed in last session

--With assistance from Ravil Shirodkar.

To contact the reporter on this story: Eric Lam in Hong Kong at elam87@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen, Divya Balji

©2019 Bloomberg L.P.